Market Commentary – August 2025

11/09/2025

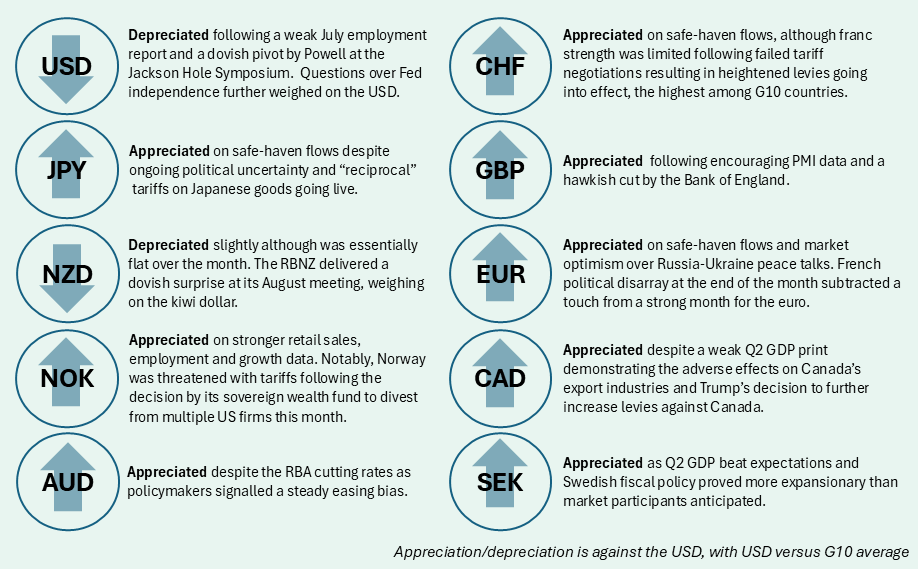

Key Themes Driving Currency Markets

Poor Payrolls Print, Fed Drama Drive USD Downtrend

Following a bout of strength in July, US dollar momentum reversed course in August as labor market weakness and speculation on the future of the Fed clouded the outlook. Initial USD weakness struck early in the month following the July nonfarm payrolls report which printed below expectations. However, it was the large downward revisions to May and June data that captured market attention. In a blink, the assessment of the labor market had gone from cooling but stable to nearly frozen over. Exacerbating the poor employment print was President Trump’s decision to fire the head of the Bureau of Labor Statistics and install a loyalist in the seat, raising market anxieties over the possibility of future data manipulation.

The question of Fed independence returned to the forefront as the Trump administration moved to influence and reshape the Fed Board of Governors. Early in the month, Trump nominated Stephen Miran to replace outgoing governor Adriana Kugler. Although he has yet to be confirmed, Miran has been floated as a possible candidate for Fed Chair, and he has previously called for greater Presidential control over the central bank. The President renewed his offensive later in the month, ordering the dismissal of sitting governor Lisa Cook over allegations of financial misconduct. The attempt to fire Cook alarmed markets, and the pending lawsuit from Cook against the Trump administration has the potential to be a landmark decision in determining the Fed’s independence from the executive branch.

Amidst the drama, Chair Powell took the lectern at the annual Jackson Hole Symposium and delivered a long-awaited dovish pivot. Market participants homed in on Powell’s acknowledgement that current policy is restrictive, and that it is “time to adjust.” Traders added to their 2025 rate cut bets in the aftermath, with OIS pricing teetering between 2 and 3 cuts by end of year. Risk assets quickly picked up steam on Fed easing bets, simultaneously sending US yields and the USD lower. That said, the Fed’s commitment to 2% inflation and noncommitment to a specific measure of maximum employment leaves policymakers flexible in this uncertain macro environment and not necessarily committed to deep cuts, perhaps to the disappointment of risk investors and the President.

G10 Grapple with Trump Tariffs

President Trump’s “reciprocal” tariffs took effect on August 7, lifting US import duties to their highest levels in decades. Notably Switzerland failed in an eleventh hour bid to strike a deal with the US and now faces a 39% rate, among the highest in developed markets. That said, the franc has managed to hold its own rather well against the dollar but has depreciated vs. the remaining G4 currencies which managed to strike deals before the August deadline. Canada re-entered Trump’s crosshairs as the President ordered an increase in levies to 35% from 25%, an action which has weighed heavily on CAD. Despite the lack of retaliation from trading partners, markets read the broadened tariff map as growth negative for US and global trade, dulling support for the dollar.

Policy Predicaments Aplenty

The Bank of England delivered a 25bps cut at its August meeting as expected, but the split vote (1-4-4) one for 50 bps, four for 25 bps, and four to hold, was more hawkish than markets anticipated. The surprise split implied a slower easing path and triggered a knee-jerk rise in GBP as the market priced “tighter for longer.” While the BoE still sees rates on a downward path, elevated inflation (with CPI projected to peak near 4% later this year) and uncertain growth keep risks two sided in the UK. Across the Channel, France’s fiscal situation entered a decisive moment as Prime Minister Bayrou stares down a no confidence vote as he strives to gain Parliament’s approval for his proposed spending cuts. Bayrou is likely to lose the confidence vote, set for September 8, increasing international concerns over France’s growing debt crisis.

Japan continued to navigate its own leadership crisis in August. Despite the ruling LDP party losing its upper house majority in July elections, Prime Minister Shigeru Ishiba vowed to maintain his position. Although local press has indicated Ishiba is likely to resign sometime in September. Safe-haven flows helped the yen to recover some strength following a particularly gloomy July, but the prospect of political instability may further delay BoJ hikes, potentially limiting future yen strength.

N.B.: This summary includes market events and currency movements up to end-of-August.

Please click here for additional information, including risk disclosures.