Market Commentary – January 2026

13/02/2026

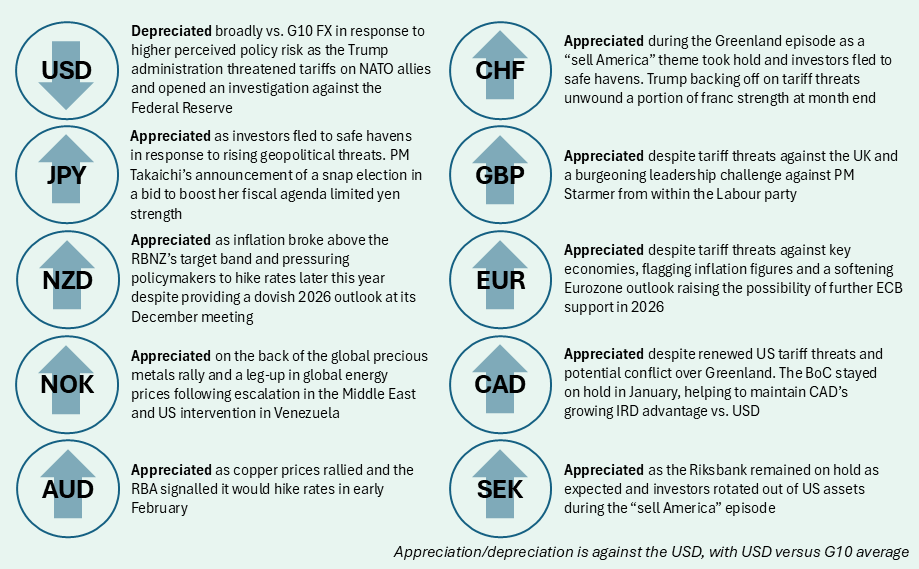

Key Themes Driving Currency Markets

Trump Ups Policy Aggression in Year Two

Investors had little time to relax following New Years as the Trump administration launched an aggressive policy offensive to begin 2026. Domestically, Trump ratcheted up pressure on the Fed with the DOJ announcing a criminal investigation of Jerome Powell over cost overruns related to the renovation of the Fed’s headquarters in D.C. Powell responded forcefully, framing the action as an attempt to undermine monetary policy independence rather than a genuine oversight inquiry. Fed pricing was largely unmoved in the aftermath, as markets expect Powell and the FOMC at large to hold fast against the President’s policy meddling. The December FOMC minutes showed officials were in a tight split over a 25bps cut, and the Committee is now squarely in a holding pattern as it waits for data to catch up post-government shutdown. December payrolls and CPI printed softer than expected but had little effect on market pricing with analysts expecting just two cuts in 2026, in line with the Fed’s own projections. The announcement of Kevin Warsh as Trump’s pick to succeed Powell was deemed as credible by markets, but as he is one of only 12 votes on the committee, pricing was unmoved despite his dovish proclivities.

Mounting geopolitical pressures underpinned monthly spot movements, driven by US foreign policy actions. Following months of dispute over alleged drug trafficking, and an effective US naval blockade on Venezuelan oil exports, US forces captured Venezuelan President Nicolas Maduro in a shocking attack that unsettled world markets. Despite the brazenness of the operation, the initial FX reaction was muted, as markets deemed US control of Venezuelan oil operations would have little material effect on global oil markets. As such, FX impact was limited to the LatAm space which broadly appreciated vs. USD.

Buy Greenland? How About Sell America?

Some dollar firming against the G10 took place as Trump reportedly mulled airstrikes on Iran to capitalize on ongoing anti-regime protests. Trump ultimately backed off on attacking Iran, but instead turned his attention to Greenland, threatening tariffs against eight NATO allies if they did not consent to US possession of the territory. This new geopolitical flashpoint reversed the dollar’s fortunes and drove a wider “Sell America” wave across markets. USD behavior evoked post-Liberation Day moves, in which historical USD correlations frayed, and the dollar weakened alongside US equities and bonds as investors pulled out of US assets.

The rest of the G10 scrambled to respond to US aggression, with EU leaders mulling a policy response via the EU’s anti-coercion instrument. The so-called “trade bazooka” would sanction US companies and individuals, severely damaging access to the European market, and a potentially devastating scenario for American tech firms which have propped up US growth momentum in recent quarters. The euro and Swiss franc strengthened on safe-haven flows as investors rotated out of dollar-denominated assets.

Pound appreciation was more muted following Trump’s threats, as the UK was poorly positioned to absorb new tariffs. The EU has proven resilient to tariffs, and the new round of threats applies to only a portion of its members, allowing EU exporters to potentially reroute shipping through unaffected members to circumvent new levies. Such an option is not available to the UK and the ability of Starmer to secure a lower tariff rate, as he did in 2025, has faded as the relationship between the Prime Minister and President Trump has turned increasingly embittered. The US eventually reversed course on its threats against Greenland, allowing for some recovery in USD-denominated assets, but the crisis reinforced the ongoing deterioration in Euro-American relations.

Japan Turns Inward

Greenland-linked safe-haven appreciation was less pronounced for the yen, which struggled following Prime Minister Takaichi’s call for a snap election in Japan’s lower house. The election, set for early February, presents Takaichi an opportunity to capture a majority government and unlock her fiscal policy agenda. Takaichi, a fiscal dove, has been politically limited by her currently tenuous position as leader of a minority coalition. An LDP majority would hand Takaichi a mandate for fiscal expansion, with renewed fiscal sustainability risks expected to weigh further on the yen in such a scenario. Indeed, Long term JGB yields underwent a stark rise following the election announcement, and expectations of fiscal largesse in the event of an LDP victory, or the re-emergence of fiscal risk premia in the case of a defeat, intensified bear-steepening pressure and limited JPY strength.

N.B.: This summary includes market events and currency movements up to end-of-January.

Please click here for additional information, including risk disclosures.