Market Commentary – September 2025

13/10/2025

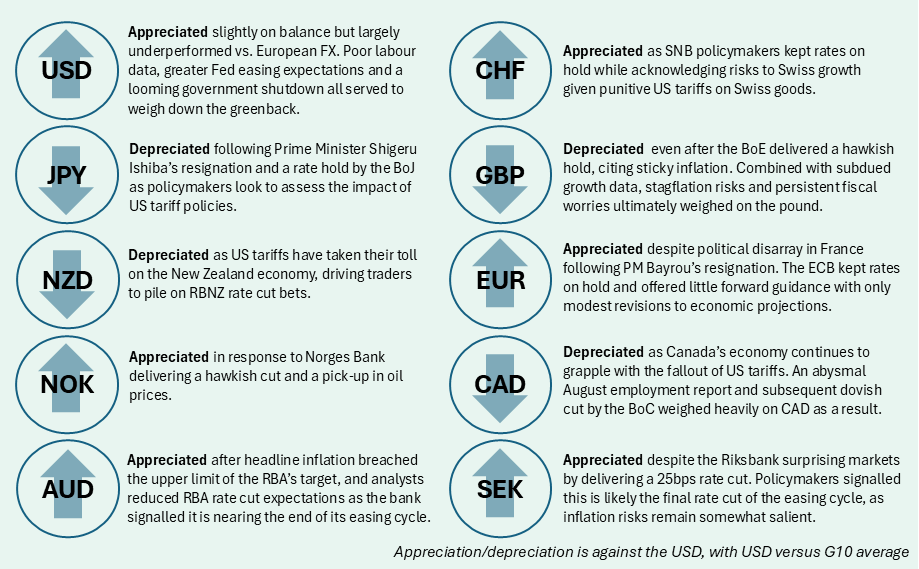

Key Themes Driving Currency Markets

FOMC in “Risk-Management” Mode

Downbeat labour data and a cloudy policy outlook contributed to mixed US dollar performance in September. Early USD momentum in the month came to a halt after August nonfarm payrolls printed at just 22K, well below even the modest expectations of 75K jobs added. The poor employment report was followed by a warmer CPI report later in the month, leaving the Fed with immediate threats to both sides of its dual mandate. Accordingly, the September FOMC meeting was closely watched as policymakers delivered the first rate cut of 2025 alongside fresh economic projections. The 25bps cut was widely expected, but the new SEP (Summary of Economic Projections) revealed little collective conviction within the FOMC body. The updated dot plot showed a wide dispersion in rate expectations, with new Fed Governor Stephen Miran making his presence known by calling for 200bps worth of cuts by year end. Miran’s stance remains an outlier, and Chair Powell cautioned September was a “risk-management cut” and avoided committing to a clear rate path. USD strengthened moderately in the days following but was soon stonewalled by the looming US government shutdown at the end of the month. A major concern is the suspension of economic data publication from the BLS and Census in the case of an extended shutdown, leaving market participants and policymakers flying partially blind.

Bayrou’s Demise, Ishiba’s Exit

Leadership questions loomed over France and Japan this month as both nations saw their respective Prime Ministers head for the exit. Early in the month, the French government collapsed for the second time this year after PM Bayrou lost a no confidence vote in the National Assembly. In Bayrou’s place, President Macron named his ally, Sébastien Lecornu, as his fifth PM in just two years. As of this writing, Lecornu has resigned his positioned following poor reception to his cabinet appointments, leaving whomever the next PM is the unenviable task of navigating a hung parliament in an effort to pass a 2026 budget bill by year-end. Amidst the fiscal chaos, Fitch Ratings downgraded French sovereigns from AA- to A+, raising borrowing costs for the increasingly indebted government.

Simultaneously, a leadership battle unfolded in Japan after Prime Minister and LDP party leader Shigeru Ishiba resigned following the loss of his party’s upper house majority in the July elections. JPY weakened as markets anticipated the conservative candidate, Sanae Takaichi, to become the new prime minister and LDP party leader. Takaichi is sympathetic to expansionary Abenomics-style policies and easier monetary policy, contrasting her primary opponent, Shinjiro Koizumi, who favours fiscal consolidation. As of this writing, Takaichi emerged victorious in the LDP leadership vote and is poised to capture the prime minister position. The yen fell sharply in the aftermath as market participants anticipated her pro-stimulus policies would result in a slower timeline for BoJ rate hikes.

Central Bank Blitz

Alongside the Fed, concurrent central bank meetings helped to drive FX movements this month. The BoJ, BoE and ECB all kept rates on hold, although respective FX outcomes were mixed. The Bank of Japan remained hesitant to raise rates amidst the LDP leadership fight, contributing to political uncertainty in the region and yen weakness. Pressure for a hike is building, with odds already firming into the October meeting, and Governor Ueda remarked that if the warmer inflation outlook is realized, the BOJ will continue to raise rates. The Bank of England delivered a hawkish hold, citing persistent inflation pressures. However, subdued growth and fiscal concerns over the Autumn Budget and the possibility of higher taxes have raised the spectre of stagflation, contributing to middling GBP performance. Across the Channel, European Central Bank policymakers offered little forward guidance and made only small adjustments to economic projections. Nonetheless, European FX performed decently this month in the face of waning US economic strength and the Fed resuming its easing cycle.

The Bank of Canada found itself in a challenging position following a dismal August employment report earlier in the month. The resulting dovish cut weighed heavily on CAD as policymakers look to soften the damage from tariffs on the Canadian economy and avert recession. NZD similarly struggled amidst less sanguine economic data. Following a downside miss in Q2 GDP, market participants added to their rate cut expectations ahead of the RBNZ’s next meeting in October, with a material risk of a 50bps cut priced in.

N.B.: This summary includes market events and currency movements up to end-of-September.

Please click here for additional information, including risk disclosures.