Market commentary – November 2024

09/12/2024

Key Themes Driving Currency Markets

Trump Election Victory Pushes USD to 12-Month High

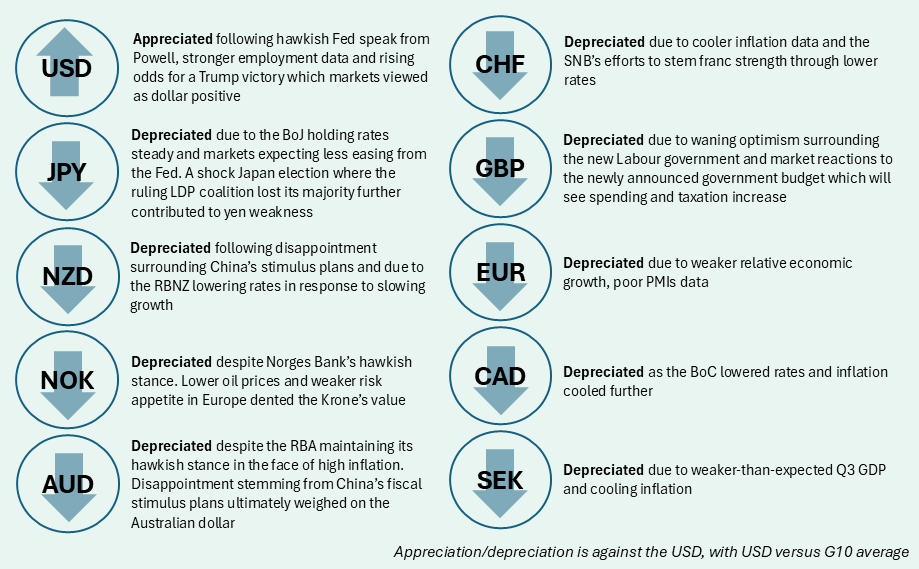

Global political developments dominated the FX space in November with the U.S. presidential election acting as the primary driver of broad dollar strength over the month. In the leadup to election day, dollar strength picked up as Trump’s odds of winning improved, driven by expectations of Trump’s fiscal, tariff, and deregulatory policies. Trump’s subsequent victory drove USD strength in the days following the election, closely mirroring the post-2016 USD rally. However, the rally paused in late November as markets reassessed the possibility of a December FOMC rate cut. Powell and his fellow FOMC members have shied away from commenting directly on Trump’s victory, and communique following the election has lacked speculation on the impact of future U.S. policy. With less definitive forward guidance, market pricing moved back towards the Fed’s dot plot projections.

The Second Trump Administration Takes Shape

Markets digested a slate of cabinet nominations from Trump and his team, with particular attention paid to his commerce and treasury picks. Trump nominated Robert Lighthizer for Trade Representative and Cantor Fitzgerald CEO, Howard Lutnick, for Commerce Secretary. Both nominees align closely with the incoming President’s ideology and can be expected to aggressively pursue his tariff agenda. Trump’s choice for Treasury Secretary, Scott Bessent, was welcomed by markets as a more moderate pick. Bessent is a strong proponent of tariffs, but he is expected to implement trade policy with a more measured, gradualistic approach. Bessent seeks to address the growing U.S. deficit, however, he also expressed support for making the Trump tax cuts permanent, which would likely support dollar strength. Overall, Trump’s nominees leaned hawkish and indicate trade is a high-priority issue for the incoming administration, and that future tariff proposals and cabinet announcements will be key dollar drivers going forward.

To that end, not long after Bessent’s nomination, Trump made a surprise post on social media where he announced plans to impose a 25% tariff on all imports from Mexico and Canada. Trump also threatened a 100% tariff on any nation seeking to move away from USD as the global reserve currency, a threat likely directed toward a large swathe of BRICS countries. Most surprising was the announcement of a further 10% tariff on all imports from China. This fresh tariff would be in addition to existing tariffs on Chinese goods, but the combined magnitude still undershoots the 60% tariff Trump had previously discussed during his campaign. The announcement of tariffs against key trading partners, Canada and Mexico, as well as China and its sphere of influence is indicative of the more transactional approach of the incoming administration. The affected currencies initially depreciated in response but soon stabilized as investors weighed the risks of these tariffs being bargaining chips for other political concessions rather than being genuine policy measures.

Eurozone Political Disarray Weighs on Euro, Supports Pound

The euro bore the brunt of dollar strength in November. Disappointing economic activity data led markets to price additional rate cut by the European Central Bank (ECB) in 2025. By month-end, markets expected five cuts from the ECB in 2025 compared to just two from the Fed, widening the dollar’s rate advantage. Political instability in France and Germany has further eroded the euro’s value. The budget battle in France made little progress, and by the end of the month, PM Barnier was staring down a no-confidence vote from both the left and right parties. The collapse of Germany’s ruling coalition earlier in the month added to the euro’s headaches. In contrast, the British pound has performed slightly better than the euro, supported by its relative political stability. The Bank of England (BoE) delivered a rate cut at its November meeting, but it was accompanied by mildly hawkish comments, and markets expect the BoE to remain on hold until February of next year. Externally, escalation in the Russia-Ukraine war raised concerns of a repeat of 2022 market conditions, during which the risk of gas shortages and an expanded military conflict weighed on European assets. The euro also suffered from the disappointing Chinese fiscal stimulus announcement.

JPY Levels Tested, but Ultimately Recovers

The Japanese yen, after some initial weakness, strengthened against USD following the election. The Ministry of Finance, which had signalled potential intervention around the 155-156 levels, ultimately avoided acting. As U.S. rates eased through late November, the likelihood of a December or January rate hike by the Bank of Japan (BoJ) rose, driven by an economy that continues to align with the BoJ’s forecasts. Notably, the yen has also intermittently reclaimed its status as a safe-haven currency, supported by European geopolitical risks. Prime Minister Ishiba retained his role as PM, even after his ruling coalition lost its majority in October. That said, Ishiba was unable to secure a majority and his LDP party will be forced to rule as a minority government. Without a parliamentary majority, passing key legislation and implementing structural reforms that move Japan away from the current Abenomics fiscal framework will likely be difficult.

N.B.: This summary includes market events and currency movements up to end-November.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 9th December 2024 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.