Market Commentary – June 2025

08/07/2025

Key Themes Driving Currency Markets

All the World’s a Stage

Geopolitics dominated headlines this month as trade developments and conflict in the Middle East drove FX price action. Tensions between Israel and Iran reached a flashpoint on June 13, with Israel targeting Iran’s nuclear program via a 12-day air campaign against military assets and energy infrastructure. Iran responded in kind with strikes on Israel, and the conflict escalated substantially with the entry of the US which conducted airstrikes on Iranian nuclear facilities. Market anxiety peaked following Iranian reprisals on a US base in Qatar as market participants feared spillover effects on global oil markets (e.g. Iran closing the Strait of Hormuz). However, the war came to a rapid resolution and a ceasefire was agreed to on June 24, allowing for a decline in oil prices and recovery in global risk sentiment.

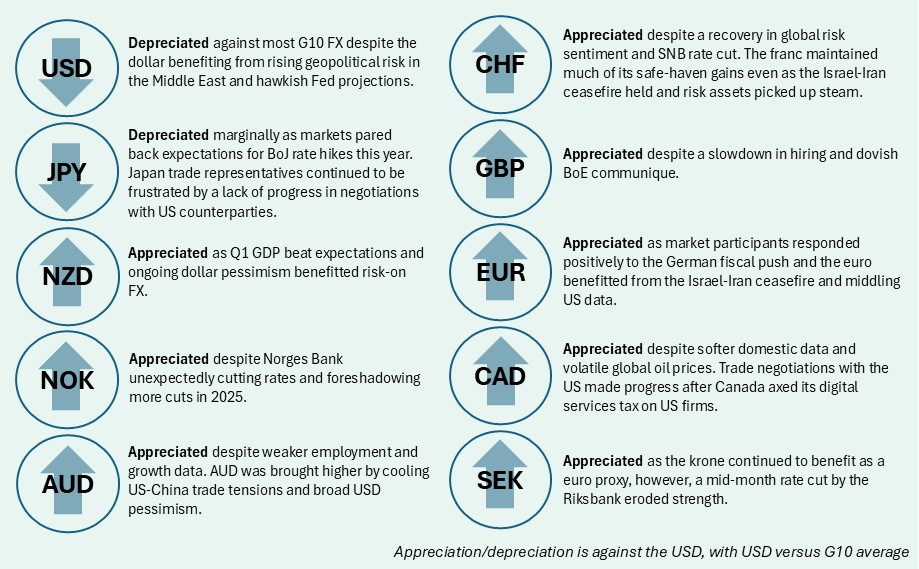

The resulting FX price action favoured the US dollar, demonstrating the greenback still possesses some degree of safe-haven appeal. The ceasefire and subsequent recovery of global sentiment unwound much of this safe haven premium, and tariffs quickly returned to the forefront. Some stability came in the form of a tentative trade agreement between the US and China, announced on 11th June, following two days of negotiations in London. The deal would set US tariffs on Chinese imports to 55% and Chinese tariffs on US goods at 10%. However, the announcement was overshadowed by China demanding sensitive information from rare earth importers, leading to concerns over data security and industrial espionage. Nonetheless, ongoing de-escalation in this theatre has helped to boost US consumer sentiment, which rebounded from near pandemic lows.

US Macro Outlook Fails to Inspire

Tariffs have muddied the US growth outlook, reflected in the Federal Reserve’s June projections which revealed higher inflation and lower growth estimates over the next three years. Although policymakers trimmed their rate cut forecasts for 2026 and 2027, it wasn’t enough to overcome increasing dollar pessimism. Chair Powell continued to stress a “wait-and-see” approach to monetary policy as policymakers struggle to discern the effects of tariffs and ongoing trade negotiations.

CPI measures unexpectedly cooled in May, with both headline and core inflation rising 0.1% over the month, translating to 2.4% and 2.8% YoY growth, respectively. Both measures undershot consensus as the effects of the Trump administration’s tariff regime have been slow to turn up in US inflation figures. Core goods prices, where higher tariff rates are expected to be felt most directly, softened over the month as firms have dipped into existing inventories to stave off price increases, at least for now. The softer CPI data were compounded by the May PPI release which also came in below consensus. Favorable inflation figures may provide the Fed additional leeway for interest rate cuts later this year, and President Trump used the opportunity to place pressure on the central bank to deliver a full-point cut. Given Powell’s hawkish Congressional testimony, such a move is seen as unlikely, and there are growing concerns that President Trump may appoint a “shadow Fed Chair” to the FOMC to influence monetary policy before Powell’s term ends in 2026, thereby undermining Fed independence.

European Central Banks Take Their Turn

The back end of this month-to-date saw various central banks release their monetary policy decisions, which were aligned with expectations (for the most part). The Bank of England maintained the Bank rate at 4.25%, following a 6-3 majority vote. This decision was made on the basis that YoY CPI growth increased to 3.4% in May (in line with expectations), and is expected to remain approximately at this level, before falling back towards target next year. The SNB lowered their policy rate by 25 bps to 0%, counteracting lower inflationary pressure. In Switzerland, inflation fell from 0.3% to -0.1% in May and, following on from strong GDP growth in Q1 2025, Swiss economic growth is expected to remain subdued for the remainder of the year. On 19th June, the Norges Bank announced a surprise policy rate cut of 25 bps to 4.25%, which had not been anticipated by the market. Due to the unexpected nature, the market reaction was significant, with the US dollar up 1% against the krone on the day and the euro up 0.8%. This decision came about due to inflation falling faster than envisaged and weak labour market developments signalling spare capacity in the Norwegian economy.

N.B.: This summary includes market events and currency movements up to end-of-June.

Please click here for additional information, including risk disclosures.