This is the archive page

Markets are no stranger to debate over US dollar hegemony, and history serves as a useful reminder that new reserve currency regimes can occur every century or two. Shifting geopolitical ideologies, the prospect of digital alternatives, and a recent cycle of dollar strength have investors once again questioning the medium-term validity of the US dollar as the world’s reserve currency. Aspirations to break from US-centric trade and finance are becoming most pronounced in a select group of economies, including China, Russia, Brazil, South Africa, and Saudi Arabia, but the idea extends more broadly as either a shared political distaste for the West, or as a reflection of the difficulties so often associated with reliance on US dollar funding in trade and finance.

A clean break from the US dollar?

In some cases, a clean break from the US dollar may be the only option when US and Western sanctions start to bite. For instance, the sanctioning of some $300bn in reserves by the West and exclusion of Russian banks from the SWIFT payment network has left Russia increasingly reliant on renminbi-denominated financial services. This includes payment networks (e.g. China’s Cross-Border Interbank Payment System), corporate debt financing, and even savings products with around 50 Russian financial institutions already offering yuan savings accounts. Assuming geopolitical tensions remain, some level of de-dollarization (and subsequent “yuan-isation”) from this source is likely to continue.

However, in other cases, such as Saudi Arabia’s plans to invoice some oil trade in renminbi, divestment from the US dollar is less intuitive and may be limited in the medium-term. Saudi Arabia relies heavily on China, its largest source of demand for oil. However, invoicing in renminbi introduces revenue volatility when converting to US dollars, to which the Saudi riyal is pegged. Without a shift in currency policy towards the renminbi, this could pose a residual risk to the currency peg, unless hedged. Agreements such as this, along with Brazil’s similar intent to trade with China in renminbi, may be more concessional in nature, aimed at building geopolitical relationships with China beyond trade.

While its possible that the US dollar will continue to lose ground in terms of trade invoicing, a deeper question is whether the evolving denomination of trade can extend structurally to the denomination of global assets and liabilities. Trade is a “flow” concept, while the final destination of such trade revenues in asset or “stock” form matter more for the existentialism of the US dollar. For instance, Saudi Arabia may opt to invoice oil sales in CNY, yet still convert the resulting funds into US dollars and then purchase US Treasuries for reserve management purposes.

The rise of the renminbi?

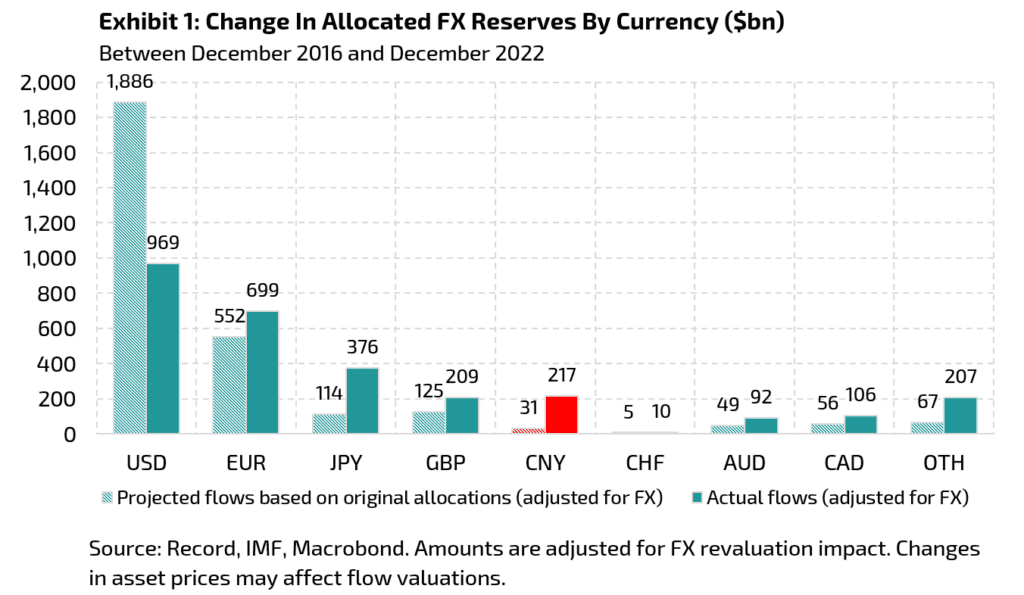

The US dollar’s share of global FX reserves has indeed fallen quite rapidly since 2016 from 65% to 58% in 2022 at current market valuations (Exhibit 1), despite a growth in reserves overall. Our estimation reveals that reserve managers’ excess supply for US dollars amounted to nearly $1tn during the same period, with demand shifting mainly towards Japanese yen ($260bn), euros ($150bn), and the renminbi ($190bn). It is noteworthy that demand for Chinese reserve assets has been strong, given that in 2016 only $91bn of allocated reserves were invested in China. This likely reflects a combination of “push” factors such as US sanctions, and “pull” factors such as higher yields.

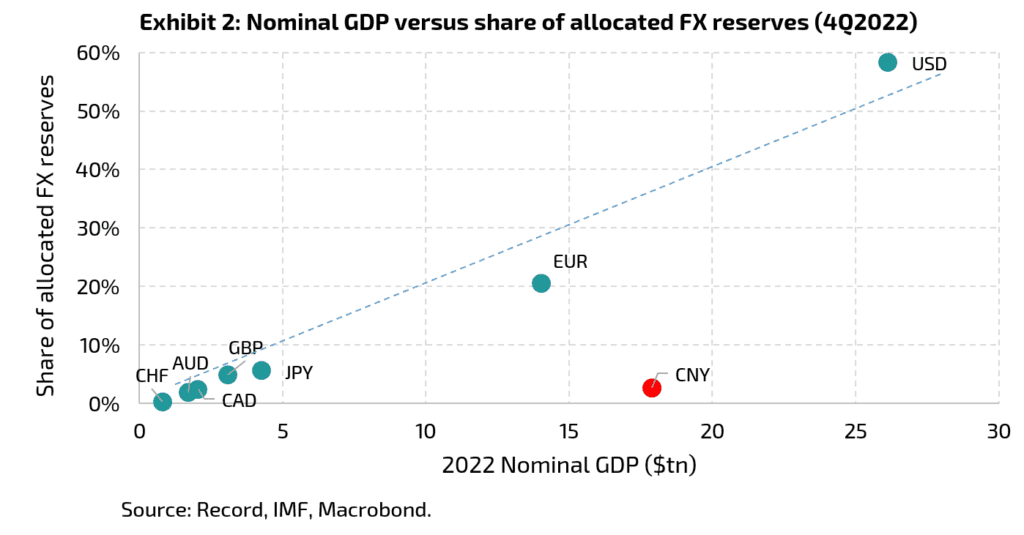

However, at 2.7% of FX reserves, the overall share is exceptionally low for the nominal size of the economy. Based on nominal GDP alone, the Chinese share of reserves should be closer to 30% than 3% (Exhibit 2). For a currency to realise its potential in reserve allocations, it must imbue the notion of safety and stability on international reserve managers. This is helped by having:

- Capital openness: convertibility and the freedom for investors to repatriate capital

- Net debtor position: reliable issuance of debt claims made possible by current account deficits

- Trust in governance: rule of law, government effectiveness, and policy transparency

Hurdles remain for the Chinese renminbi

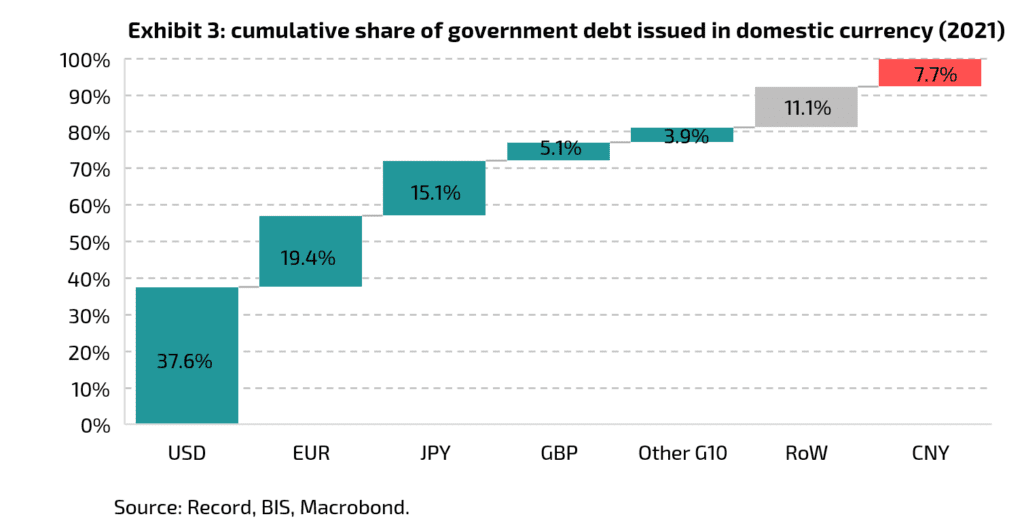

Despite ongoing efforts to internationalise, the renminbi remains a heavily managed currency, under a complicated three-system exchange rate[1], and with a specific mandate by the People’s Bank of China to maintain stability versus a trade-weighted basket of currencies. Ironically, in order to achieve this, the central bank has to draw upon its $3.1tn holdings of US Treasuries to intervene against the US dollar, and also tightly controls what capital can enter or exit the country. As long as China continues to run current account surpluses, capital will also be outwardly recycled, hindering the growth of its own debt market, which is still small relative to the US and collective West’s (Exhibit 3).

China’s geopolitical stance on Taiwan is also unlikely to foster the confidence required for many reserve managers to materially allocate to China; we estimate that over thirty percent of reserve assets are held by Western-aligned countries that would be concerned about repatriation risk. On the other hand, only seven percent are held by countries that appear to openly support China’s foreign policy, giving some idea of the upper bound from this group. The remaining sixty percent of assets belong to more neutral countries in-between. Vital to the outlook will be China’s soft influence on these countries, including the BRICS and Belt and Road countries, to the extent that commingled economics elevate the renminbi as a preferred currency.

Some now consider China’s move to mainstream its digital currency (the e-CNY), and propagation of its cross-border payments infrastructure (e.g. M-Bridge) to be the new threat to the primacy of the US dollar system. But we would be wary of conflating digitalization with structural reformation of the international currency landscape. The e-CNY could help China grow its share of invoicing in renminbi, but transacting in a currency does not translate to increased net demand except through secondary impacts for example via trade or investment preferences. Crucially, for the e-CNY to broadly replace the US dollar, its success also remains contingent on becoming interoperable with other countries’ payments systems. Given growing concerns around China’s digital authoritarianism and exports thereof, some countries may be reluctant to interface.

A more fragmented currency landscape

It is important to note that many of the discussed factors could change. For instance, the US and China could suddenly sever their symbiotic economic relationship over Taiwan. At first this would likely support the US dollar through safe haven risk channels, though in the medium-term it could force upon China the external adjustment required to facilitate a growing share of reserves. Or, more countries could gradually fall under China’s sphere of influence, trading off more opaque investment risks for the economic benefits it affords them. Other factors aside, this could weigh on the US dollar at a longer (three plus years) horizon. At present, we anticipate that any transition will be slow and incomplete on account of differing geopolitical ties. As a result, we expect a more fragmented currency landscape, revolving around the US dollar with smaller reserve currencies like the euro and yen still playing a role, followed by the Chinese renminbi. This shift towards separate spheres of currency influence is likely to be driven increasingly by economic and political disagreements, shaping the new currency order for the decades to come.

[1] China has an onshore CNY market, and offshore CNH market out of Hong Kong, and a non-deliverable CNY forward market.