Market Commentary – September 2024

- Published: 11/10/2024

Fed policy drives the greenback, economic data secondary

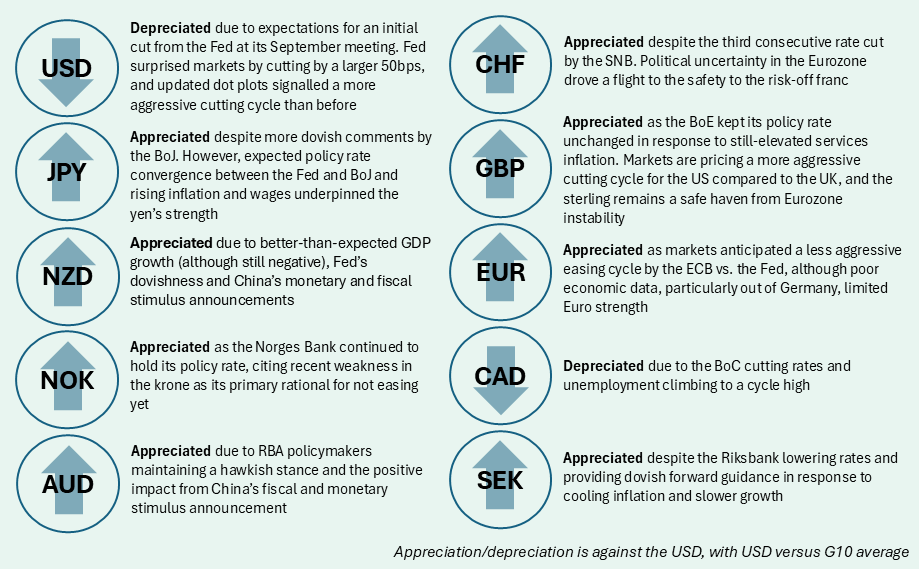

The US economy demonstrated its resilience in September following a tumultuous August during which fears of a hard landing roiled markets. The August employment report undershot consensus, but the 142K print was still an improvement from the prior month, and the unemployment rate ticked down as well. Furthermore, initial jobless claims fell to a four-month low, suggesting that the US labor market, although running cooler than a year ago, was not outright deteriorating. Retail sales also came in stronger than expected, supported by sustained real income gains for households. The raft of positive economic data helped ease recession fears, but expectations for an initial rate cut from the Fed at its September meeting weighed on the dollar. The Fed ultimately voted to cut its policy rate by 50bps at its September meeting, coming as a surprise to market participants which were split on the size of the cut. The decision was characterized by Fed Chair Powell as a strategic response to evolving policy conditions rather than a reaction to weak labor data. The updated dot plot also signalled a more aggressive cutting path than previously projected, and the market responded with the US dollar weakening against nearly all G10 currencies. The move lower in the dollar in September despite resilient US data demonstrates the more policy-driven nature of the greenback now as the Fed’s policy path is measured against other G10 banks.

Yen impacted by dovish communique and political change

Central banks across the globe also made significant policy decisions. The Bank of Japan opted to hold rates as it signalled future rate hikes will be conditional on the smooth functioning of markets in addition to economic considerations. Further dovish comments from Governor Ueda and stronger US data weighed on the yen. Japan’s political landscape also impacted the yen. Shigeru Ishiba’s victory in the Liberal Democratic Party (LDP) leadership race spurred a yen rebound towards the end of the month. Ishiba is perceived as more likely to support monetary tightening, but he also is less aligned with the expansionist “Abenomics” policies championed by previous LDP leaders.

China stimulus measures buoy regional currencies

China took decisive steps to stimulate its slowing economy. The People’s Bank of China cut the reserve requirement ratio by 0.5% and lowered the seven-day reverse repurchase rate to 1.5%. These measures aim to create a favourable monetary environment for steady growth. The stimulus announcement bolstered investor confidence, leading to rallies in Asian currencies and commodity currencies like the Australian and New Zealand dollar.

Monetary policy divergence within emerging markets

Contrasting monetary policy actions were observed in emerging markets. Brazil’s central bank raised its benchmark interest rate by 25bps in response to persistent inflation and resilient economic growth. Conversely, Indonesia and South Africa cut their key interest rates by 25 bps, shifting focus toward supporting economic growth amid favourable inflation outlooks. In Mexico, domestic political developments contributed to peso weakness. President Andrés Manuel López Obrador’s controversial judicial reforms passed, which led to the peso selling off. Looking ahead, incoming president Claudia Sheinbaum, known for her pragmatic approach to fiscal policy and investment, may stabilize the currency.

N.B.: This summary includes market events and currency movements up to end-of-September.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 11th October 2024 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.