Market commentary – May 2025

11/06/2025

Key Themes Driving Currency Markets

China-US truce temporarily boosts dollar, but “Big Beautiful Bill” raises fiscal perils

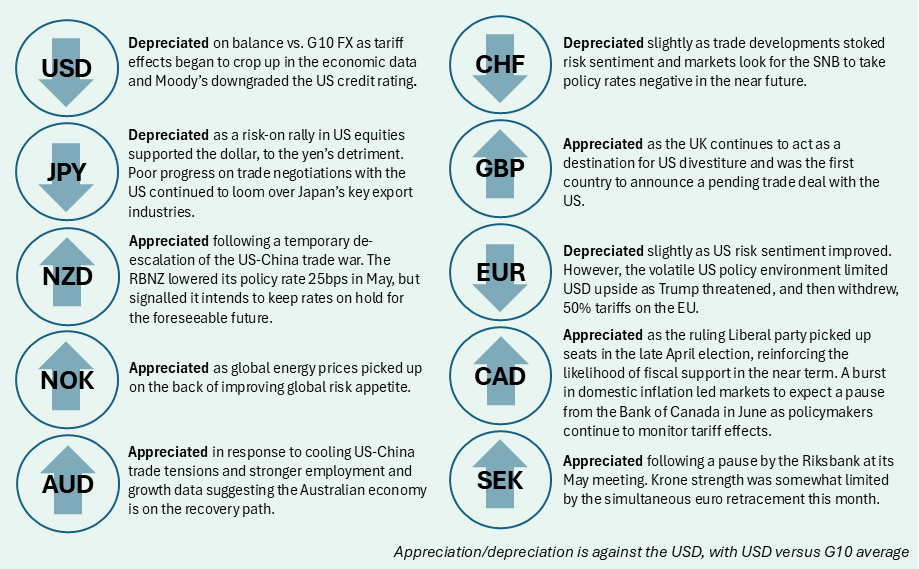

Overall USD pessimism continued into May, underpinned by slow progress on trade deals, rising fiscal risks and a downgrade of Moody’s US sovereign rating. Dollar sentiment improved in the first half of May, as hiring continued at a healthy pace, and April CPI came in softer-than-expected, helping to restore some US sentiment and allowing the USD to recover vs. safe havens. The stronger data also influenced markets to trim Fed pricing closer to two cuts in 2025, in line with the FOMC’s own estimates. Risk sentiment peaked mid-month after US and China officials agreed to a significant de-escalation in the trade war following high-level talks in Switzerland. The 90-day agreement brings US tariffs on Chinese goods down from 145% to around 30%, essentially the global 10% baseline tariff plus the 20% of fentanyl-related duties imposed pre-“Liberation Day”. De-escalation likely came at an opportune time, as the effects of China tariffs were present in higher core goods prices in April. The improved outlook allowed USD to pick up gains vs. safe havens, most notably JPY.

That said, fiscal considerations loomed large, underscored by Moody’s downgraded US sovereigns to Aa1 from Aaa. The downgrade, although a backwards-looking decision, intensified market scrutiny toward the Republican spending bill currently under negotiation in Congress. A key part of the proposed package is the extension of the TCJA tax cuts, which could see US borrowing needs balloon by 3-5 trillion USD over the next decade, per CBO estimates, and market participants made their concerns clear as long-term yields picked up on rising fiscal risks. A similar episode occurred following “Liberation Day” and may have contributed to Trump’s decision to delay full reciprocal tariffs. The bond market remains a limiting factor for both Trump’s fiscal and trade agendas, and potential market reactions will likely be considered on any policy decisions going forward.

Trade war truce boosts risk currencies

The temporary rollback of most US-China tariffs presented markets with a buy opportunity in risk assets and currencies, which rallied on the brightening global outlook. The dollar lagged the retracement in risk markets as policy confidence has yet to be meaningfully restored, evident by the market response to rising fiscal risks. The US-China truce was further compounded by a ruling by the US Court of International Trade that would undo “Liberation Day” and Fentanyl-related tariffs. The ruling is subject to appeal, but revealed the flimsy legal foundation supporting tariffs and provided further incentive for countries to take a “wait-and-see” approach rather than negotiate a potentially unfavourable trade deal.

Indeed, tariff threats from Trump are demonstrating diminishing returns, as the market showed ambivalence toward an end-of-month threat to double tariffs on the EU to 50% starting June 1. As was widely expected, Trump withdrew this threat just days later, claiming satisfactory progress on negotiations, but nebulous news on negotiations has also demonstrated limited impact on FX. The first “trade deal” announced between the US and UK was an agreement in principle and still maintained the global 10% baseline tariff, which Trump officials have communicated is non-negotiable. Japan, first in line for negotiations, is still seeking to remove the particularly damaging auto and steel import tariffs, but Japanese policymakers have communicated little progress has been made with their US counterparts.

Central banks in holding pattern

Increased economic uncertainty and the Trump administration’s erratic approach to tariffs has prompted many central banks to keep rates on hold as the economic situation evolves. The Fed kept rates steady at its May meeting and vowed to take a “wait-and-see” approach as tariff effects continue to work their way through the economic data. Policymakers at peer banks also were in no rush to adjust rates as the Bank of Japan, Riksbank and Norges Bank all stood pat this month. Even the central banks that elected to cut rates, such as the Bank of England and Reserve Bank of New Zealand, did so with the caveat that a more gradual approach to easing is the inclination of policymakers. The Reserve Bank of Australia surprised markets with a dovish tilt at its May meeting, but recent firmer employment and growth prints may limit the dovishness of RBA policymakers as they seek to bring inflation closer to target.

N.B.: This summary includes market events and currency movements up to the end of May.

Additional information

Issued in the UK by Record Currency Management Limited. All opinions expressed are based on our views as of 10 June 2025 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

We are authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario and Alberta Securities Commission in Canada, and registered as exempt with the Australian Securities and Investments Commission.