Market Commentary – January 2025

- Published: 10/02/2025

Key Themes Driving Currency Markets

Trump’s arrival, DeepSeek AI sow uncertainty in FX markets

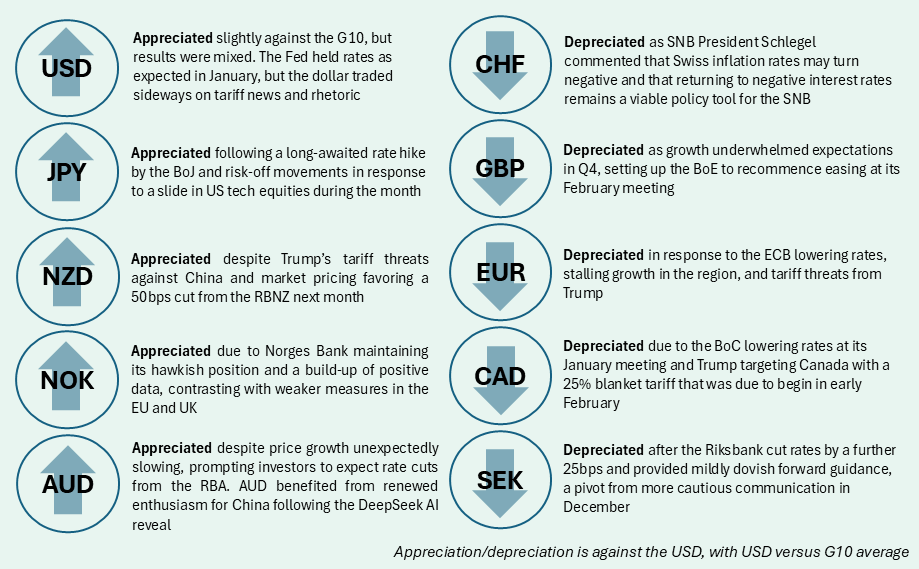

Economic data largely played second fiddle to the headlines this month, with FX price action driven primarily by President Trump’s tariff threats and developments in the AI space. Trump’s first weeks in office have proved tumultuous, with the newly inaugurated president issuing a host of transformative executive orders, including directing agencies to complete studies for potential tariffs, due April 1. The memo drove expectations for a more gradual approach to tariffs, and the dollar initially lost ground on the news. However, Trump quickly countered these expectations by announcing a February 1 start date for 25% tariffs on Canada and Mexico, and 10% tariffs on China, allowing the dollar to rebound later in the month. The market response to Trump’s tariff threats were at times mixed, with resulting USD strength sometimes proving short-lived as participants struggled to determine if Trump’s threats were credible or just a bargaining chip to gain policy concessions.

Outside of U.S. politics, the arrival of DeepSeek, a Chinese AI startup, shocked U.S. tech equities during the month and drove risk-off movements into safe havens. DeepSeek rapidly gained popularity due to its low-cost, higher efficiency chatbot that outperformed more costly established AI models such as ChatGPT. The development raised questions about the billions of dollars of funding American tech giants have devoted to AI research and the sustainability of those firms’ valuations, as well as China’s potential to challenge U.S. dominance in the AI space. USD was weaker as markets digested the news, highlighting some of the vulnerabilities of the dollar to outsized foreign equity inflows that help to fund the U.S. current account deficit.

The January FOMC meeting was largely overshadowed by the major headlines, even as the Fed elected to pause rate cuts for the first time since September. The Fed notably removed language from its meeting statement regarding progress being made on inflation, simply stating that inflation is “somewhat elevated.” The new language is in line with the core PCE deflator, which has levelled off well above the FOMC’s 2% target as of late.

Who needs enemies with friends like these?

Trump’s threat to levy a 25% tariff on Canada weighed on the Canadian dollar, pushing USDCAD to a near 4-year high during month. Canada’s economy is heavily dependent on exports to the U.S., and the implementation of tariffs would be damaging, with estimates from J.P. Morgan suggesting Canada would fall into recession within six months in such a scenario. Some optimism remained that Trump’s true goal was to force an early renegotiation of the USMCA, which may have capped USD strength. The Bank of Canada’s decision to cut rates by 25bps at its January meeting further weighed on CAD. Although policymakers clarified this was not a move done in response to potential tariffs, the BoC warned that a protracted trade conflict would most likely lead to a rapid adverse impact on economic growth.

The Eurozone escaped the first round of tariff threats, but Trump signalled that he intends to levy tariffs on the EU in the near future. Of more immediate concern was slower growth in the economic bloc. Growth in the Eurozone unexpectedly stalled in Q4, growing just 0.1% with weakness concentrated in Germany and France. In response to flagging growth the ECB cut rates by 25bps in January and signalled further reductions may follow. The ECB also communicated it expects inflation to return to target in 2025, providing cover for further easing. Despite slower growth, ECB easing and the looming threat of tariffs, the euro finished roughly flat against the G10 over the month.

Souring sentiment and weaker growth weigh on pound

Investor sentiment has soured in the UK, reflected by a rapid climb in long-end gilt rates. Economic fundamentals do not suggest an immediate slowdown in the UK economy, but fears of fiscal unsustainability and potential for stagflation have taken hold. The BoE has also faced mounting pressure to balance further rate cuts against market turmoil and sticky inflation. Deputy Governor Breeden signalled the BoE is open to easing, citing weakening activity and forecasts of slowing wage growth. A weaker-than-expected GDP print for Q4 convinced markets that the BoE would restart easing at its February meeting, weighing on the pound.

BoJ hikes, relieving the yen

The BoJ lifted its policy rate for the third time in less than a year, bringing it to its highest level in 17 years. Governor Ueda and board members cited stronger inflation and relative stability in financial markets as reasons for the decision, and the yen strengthened on expectations that further hikes could follow, particularly if wage gains and inflation remain robust. Japan has so far stayed out of Trump’s tariff crosshairs, insulating the yen from many of the headline-driven FX moves that characterized the month. Additionally, the DeepSeek AI release saw the yen benefit from the risk-off slide in U.S. equity prices.

N.B.: This summary includes market events and currency movements up to end-of-December.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 10th February 2025 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.