Market Commentary – February 2025

- Published: 12/03/2025

Uneven Tariff Talk and Weaker Outlook Weigh on USD

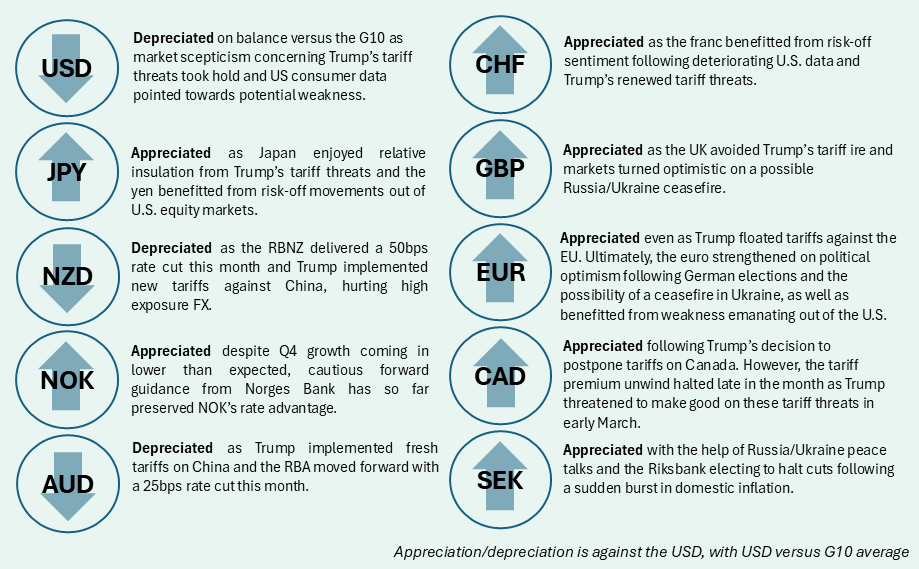

Tariffs remained front and centre throughout February as markets reevaluated the credibility of Trump’s threats. Following the postponement of tariffs on Canada and Mexico, originally set to start in early February, market participants increasingly interpreted Trump’s tariff threats as merely a negotiating tactic, allowing the USD to shed some of the tariff premium it had built up in the weeks leading up to Trump’s inauguration. Trump’s threats have generated increased uncertainty, and this has been felt in deteriorating sentiment indicators, most notably among consumers. Soft January retail sales data signalled consumers were, perhaps predictably, tightening their belts post-holidays, but it was a sudden drop in consumer sentiment and heightened inflation expectations that put markets on notice. Also on the horizon is the mid-March funding deadline for the U.S. federal government and the possibility of considerable cuts to spending. Concerns over a possible growth slowdown, fuelled by negative survey surprises and possibility of a government shutdown and/or fiscal drag, helped to weigh on the U.S. dollar this month.

Russia/Ukraine Talks Begin, Exciting European FX

Over in Europe, the U.S. surprised markets, and its allies for that matter, by reestablishing diplomatic ties with Russia and initiating talks over a possible ceasefire in Ukraine. The unilateral talks notably did not include Ukraine or European powers, highlighting Europe’s increasingly fragile alliance with the US and Trump’s newfound deference for Russia over Ukraine. The initial peace talks euphoria died down later in the month but on balance proved supportive of European assets. That said, European leaders, particularly in the UK and France, remain strongly opposed to a long-term peace deal without security guarantees for Ukraine and have signalled they will continue to provide military support to Ukraine even as Trump threatens to pull U.S. support. Nevertheless, the possibility of a peace deal excited markets and supported European FX.

Europe Closes Ranks as German Leadership Solidifies

The widening rift between the U.S. and Europe was further demonstrated by U.S. officials discussing reducing defence commitments in Europe and Trump issuing tariff threats against the EU. A contentious visit by President Zelenskyy of Ukraine to the U.S. ended with Trump and his cabinet ejecting the Ukrainians from the White House after repeatedly criticizing Zelenskyy. European powers in response reaffirmed their support for Ukraine and welcomed Zelenskyy to London for separate peace talks in the days following. European support for Ukraine further solidified this month with the victory of the CDU party in German elections, guaranteeing a strong ally in Berlin. The conservative CDU and center-left SPD gained enough seats to form a viable majority coalition, increasing the likelihood of successfully loosening Germany’s constitutional debt brake and passing fiscal stimulus. The euro got a small boost from the realized CDU/SPD coalition, but fading hope of a quick ceasefire and Trump’s tariff threats against the EU limited the euro’s upside.

Japan and United Kingdom Staying Out of Trump’s Sights

The yen was the strongest performer this month, advancing against all G10 peers. Japan’s relative isolation from Trump’s trade agenda and the yen’s safe-haven status allowed the currency to benefit from market upheaval in North America and Europe. Much of the yen’s rally can be explained by external forces, but internally, domestic data continued to print to the BoJ’s liking, with core inflation remaining close to target and real wage growth staying positive. The U.K. has similarly avoided Trump’s tariff ire. The U.K.’s resilience here likely lies in the fact that the U.K. currently runs a trade deficit against the U.S. This fact has not entirely prevented Trump from taking swipes at the U.K. on trade, particularly over steel exports to the U.S., but the President has yet to propose any blanket tariffs on U.K. goods. Trump and PM Starmer even discussed the possibility of a U.S.-U.K. trade deal during a state visit this month. Internally, the BoE elected to lower its policy rate by 25bps at its February meeting, but the decision was not unanimous, and markets took note of the bank’s hawkish rhetoric, limiting pound weakness. Better-than-expected GDP data and the possibility of a ceasefire in Ukraine further helped the pound outperform many of its G10 peers. That said, some lingering doubts over the feasibility of the ruling Labour Party’s fiscal plans following an unfavourable review from BoE policymakers limited overall pound strength.

Issued in the UK by Record Currency Management Limited. All opinions expressed are based on our views as of 11th March 2025 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

We are authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario and Alberta Securities Commission in Canada, and registered as exempt with the Australian Securities and Investments Commission.