China’s zero-COVID policy – here to stay?

25/05/2022

Part 1: Introduction

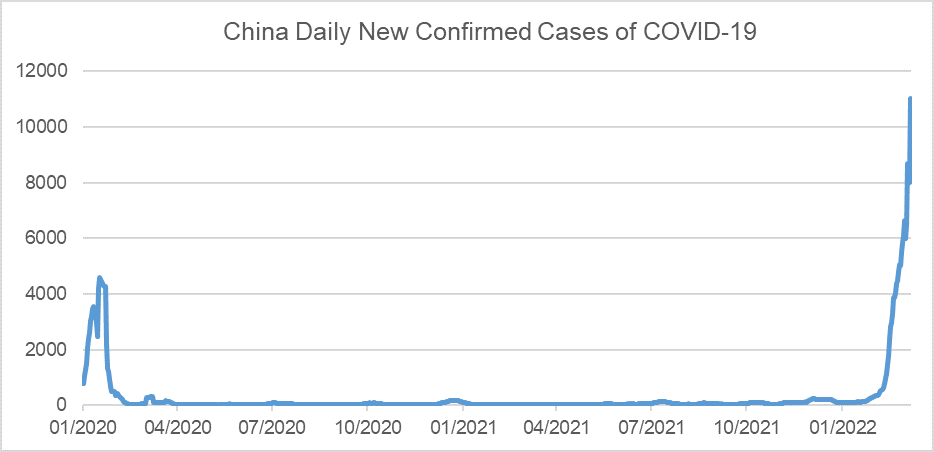

The latest wave of China’s omicron outbreak has sent daily new cases to a record high, reaching a level comparable to the initial COVID-19 outbreak in Wuhan (Figure 1). On the 28th March, Shanghai, China’s commercial and financial hub with a population of 26mn, entered lockdowns, marking the biggest city-wide lockdown since 2020. The lockdown in Shanghai was expected to end on 5th April, however, the authority decided to extend lockdowns indefinitely amid the record surge in new cases. According to an estimate from the Chinese University of Hong Kong, the current round of COVID-19 lockdowns are likely to cost China at least $46bn per month. The number could double if more cities or regions enter lockdowns. As the world gradually evolves to live with COVID-19 and returns to normal, a strictly implemented “zero COVID policy” would come at an escalating cost for China. This article sheds light on the latest development of zero-COVID policy and the near-term outlook for Chinese economy and RMB.

Source: Record, Macrobond and Our World in Data. Data as of 4th April 2022. Please note that the daily new COVID-19 cases at the start of the pandemic remain ambiguous, but having a large number registered is still meaningful for comparison.

Part 2: Latest developments

China has operated a zero-COVID policy since the pandemic began, though in March President Xi pledged to achieve “maximum prevention and control”, while minimising damage to the economy and society at the start of March, via a so-called “dynamic zero-COVID policy”. Echoing that, China’s National Health Commission issued new guidelines, suggesting to narrow the geographic scope of mass testing and require local governments to complete COVID tests for population in certain regions within 24 hours.

However, only days after Shanghai local authorities rejected calls for a lockdown, the financial hub entered city-wide lockdown to curb infections. In the latest outbreak, at least 26 government officials in Northeast China’s Jilin, South China’s Guangdong and East China’s Shandong Province were dismissed due to COVID mismanagement. These recent actions suggest that officials will continue to stick with zero-COVID without a clear transition plan towards dynamic zero-COVID policy, but the more dynamic policy may be back on the table once China passed the peak of the latest outbreak.

Part 3: What is next?

The short conclusion is China is likely to pursue zero-COVID policy through 2022 (at least before 20th National Party Congress), possibly into 2023.

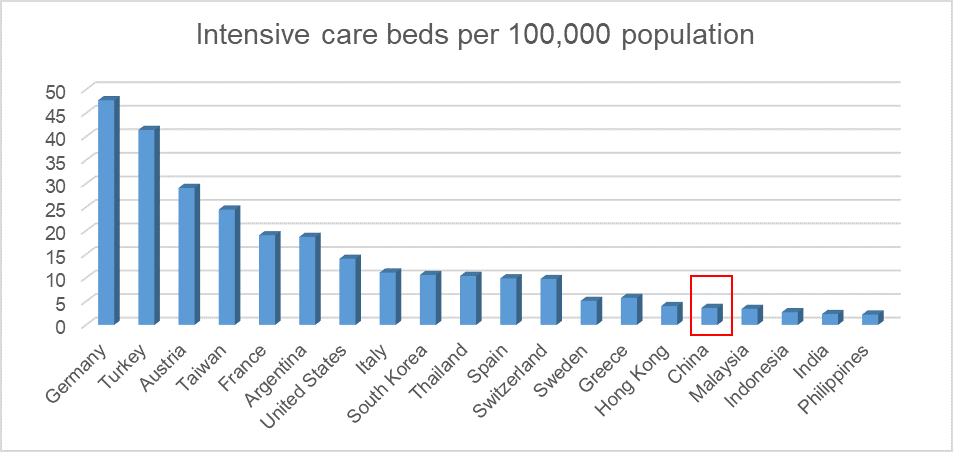

First, considering the counterfactual scenario where China chooses to live with COVID, the human cost will be high due to low vaccine efficacy, low ICU beds per capita (Figure 2) and an extremely uneven distribution of medical resources. The demographic most affected by opening-up will be the elderly, many of whom are exempted from vaccination and are the most vulnerable. The rise in infections and deaths could in turn lead to social instability and impose huge political costs for authorities ahead of the 20th National Party Congress this year (Q4 2022).

Source: Record and Our World in Data. Data as of 4th April 2022

Secondly, the authorities took pride in its success in containing large scale COVID-19 outbreaks in China and actively promoted it on social media. While there had been some opposing voices online calling for “living with COVID” policies in China, they were ferociously attacked by many netizens for disregarding human life. As such, the public tends to avoid discussing “living with COVID” online these days. Even if the Omicron variant is milder, given the large population base and the public’s aversion towards COVID, it is difficult and costly for the authority to back track and take a U-turn in its COVID stance. Scrapping zero-COVID policy would contradict previous narratives and undermine the government’s credibility.

Third, although pursing zero-COVID policy has imposed some economic costs on the Chinese economy, they were prudently minimised. The places that entered full lockdown in the past were less economically important and constituted a relatively small proportion of China’s GDP. When outbreaks of similar scale happened in tier 1 cities like Shanghai and Shenzhen, the lockdown durations tended to be much shorter and the degree of lockdowns less extensive. For instance, Shenzhen (the tech hub of China with 12.5 mn population) was locked down for only a week earlier this year, whereas Xi’an (the historical capital city of China with 8.3 mn population) was locked down for over a month. As such, the authority is not dogmatically pursuing zero-COVID, but rather doing a careful calculation of what, when and how to control outbreaks to reduce economic cost. Moreover, the social and political cost of opening up may be perceived as greater than the economic cost of locking down.

Overall, externally, China is unlikely to relax its border in the coming years. Foreign entries have to quarantine and undertake extensive tests to prevent virus/mutations from entering China. Internally, the official narrative will follow zero-COVID policy, but in terms of implementation, the authorities will weight a myriad of factors (severity of outbreak, level of economic development, medical resources, and industries affected) in implementing these policies.

Part 4: China’s Macro and FX outlook

The current rounds of COVID outbreak and the implementation of zero-COVID policy are going to weigh on China’s aggregate demand. The latest report published by the PBoC on 30th March shows that Chinese consumers are becoming more cautious as they would rather save than spend in Q1 2022 amid the spread of omicron in major cities like Shenzhen and Shanghai which has severely disrupted business and everyday activities. Given the growth headwinds, monetary, fiscal and regulatory policy easing are likely to continue in Q2 2022 to bolster the economy.

To start with monetary easing, the latest inflation data in China is at 0.9% YoY as of February 2022, significantly lower than in the US or the UK. The cooling inflation will leave more room for the People’s Bank of China to use various monetary tools to shore up confidence in the $60 tn financial system. On the fiscal side, the central government announced $393bn in tax cuts in March, with more targeted fiscal support in the coming months. After the stock market rout in March, the Chinese authorities pledged to calm financial markets by proposing a removal of punitive measures on the internet sector and to relax restrictions in the property market. On the 4th of April, Beijing modified a rule that potentially allows US regulators to access auditing reports of Chinese companies listed on NYSE. Meanwhile, Beijing rolled out a series of demand-focused polices to boost the property sector (which contributes around 30% of China’s GDP), ranging from cutting mortgage rates, loosening Home Purchase Restrictions and raising the housing provident fund loan limit etc.

Macro headwinds, monetary policy divergence, and geopolitical tensions may pressure RMB in the near-term. However, the large current account surplus and attractive investment opportunities in China still underpin demand in the medium-term. The liberalisation of the Chinese equity and bond markets, combined with potential increase in RMB reserve allocations from global central bank will provide further inflows into the Chinese capital market. The attractive real carry and the depressed valuations of Chinese stocks remain attractive to global investors.