This is the archive page

Key Themes Driving Currency Markets

A busy month for political upsets

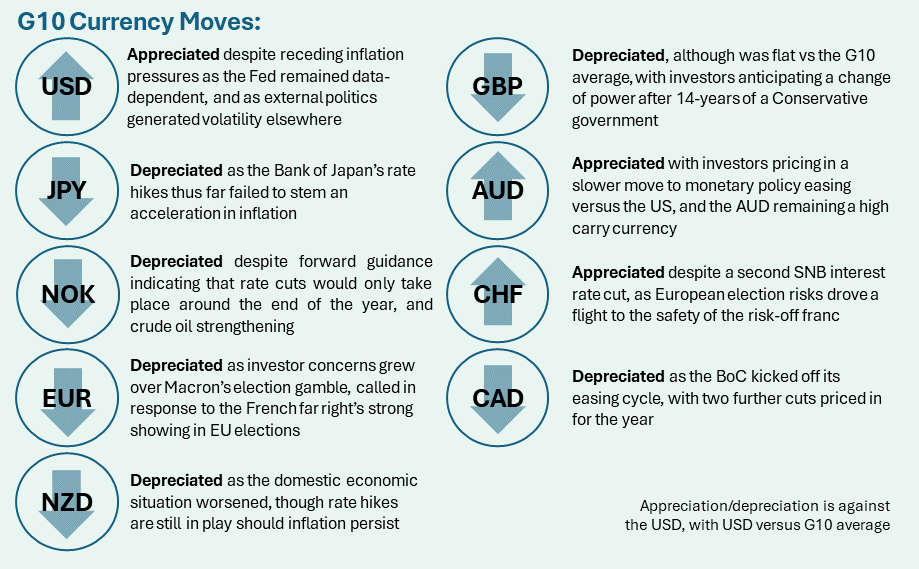

First there were EU elections which as expected saw a strengthening of the right-wing parties within the European Parliament. However, the result in France came as a major surprise as Marine Le Pen’s Rassemblement National won twice as many votes as French president Macron’s party (32% vs 15%). As a result, Macron called for snap parliamentary elections which set the tone for euro weakness as investors prepared for the possibility of a majority right-wing government. Towards the end of the month, there was also the first Presidential election debate between President Biden and Trump, where Biden’s poor performance had markets and his own party questioning his ability to run for President. The higher implied likelihood of a Trump presidency provided some support to the US dollar, as Trump’s economic policies such as higher tariffs are assumed to create a more inflationary environment, warranting a more hawkish response from the Federal Reserve. Further election upsets occurred in Emerging Markets (e.g. Mexico and India) though these had a limited wider impact on developed currency markets.

Central bank action

The Swiss National Bank cut rates for a second time and was committed to combating the downside inflation risks evident in their forecasts. However, the franc appreciated versus the US dollar as European election risks drove a flight to the safety of the risk-off franc. The ECB also conducted its first rate cut at the June meeting, but with the cut well-telegraphed, the market impact was limited. The Bank of Japan in its June meeting again disappointed markets by leaving its JGB buying program unchanged but hinted that July would be the meeting where a plan for reductions is announced. After a month of comparative stability, the Japanese yen then resumed its depreciation path, despite limited pressure from US yields. With relatively static monetary policy expectations and the yen reaching new lows of 162, concerns grew about another potential intervention by the Ministry of Finance. In contrast to the intervention in late April, the yen’s decline was gradual enough to escape any action beyond verbal warnings. Relatedly, Japan was added to the US “monitoring list” for foreign exchange practices, but avoided the label of currency manipulator, presumably because the Japanese are attempting to support, rather than devalue the currency.

US inflation pressures ease; all eyes still on the data

The Federal Reserve also met in June, but the event was overshadowed by the all-important US inflation release, which showed pressures easing for a second month in a row. A look into the breakdown suggests that pressures from the stickier “other core services” component such as motor insurance finally started to moderate. Shelter costs remained sticky but overall, the report was a step in the right direction, and subsequently led to some US dollar weakness. Nonetheless, the US dollar was able to find some support from the June FOMC meeting which came with an updated set of projections that could have been interpreted hawkishly, showing the median of just one cut for 2024 despite knowledge of new and more favorable inflation tally. Powell continued to emphasize the data dependent approach and by the end of June, markets were pricing just over one cut in 2024, taking place either in November or December.

N.B.: This summary includes market events and currency movements up to end-of-June.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 8th July 2024 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.