Market Commentary – April 2025

- Published: 09/05/2025

Key Themes Driving Currency Markets

“Liberation Day” Shock Sinks Dollar

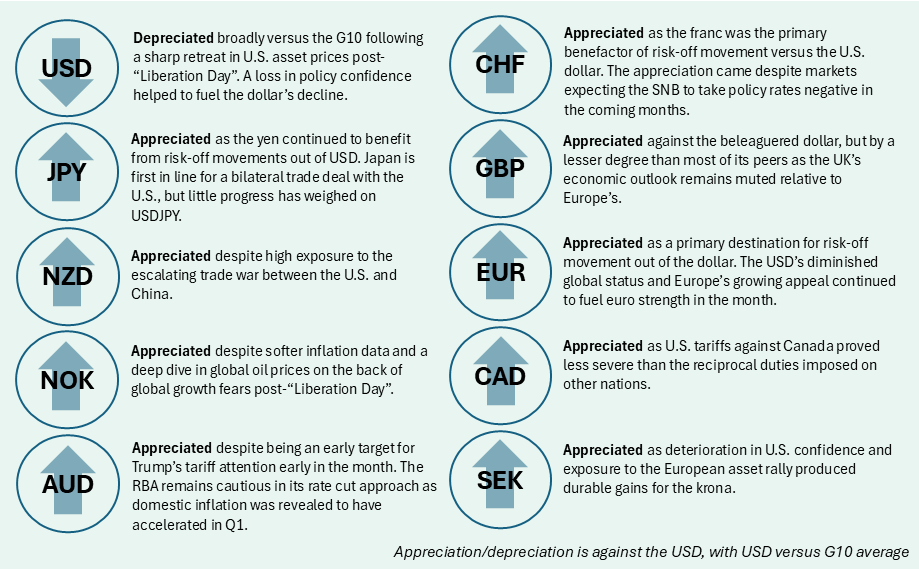

At the start of April, President Trump delivered a long-awaited address regarding reciprocal tariffs. “Liberation Day” brought forth a 10% global baseline tariff on all trade partners, with higher – sometimes significantly higher – rates on those deemed to engage in unfair trade practices. The overall rates were higher than expected and triggered significant currency moves with the dollar rapidly weakening in the aftermath amid a U.S. equity market downturn. The rapid decline in equites, and more importantly Treasurys, ultimately forced the Trump administration to institute a 90-day grace period the following week. Despite walking back the worst of the reciprocal tariffs– outside of China –investors struggled to understand the policy landscape. U.S. dollar weakness was pronounced against other reserve currencies (Swiss franc, euro, yen), while losses were more muted against cyclical and emerging market currencies amid ongoing global growth concerns.

Despite risks to the outlook and deteriorating soft data, the hard data continued to hold the line as hiring was robust and consumption spending data solid in April. That said, the threat of tariffs likely pulled forward retail sales and durable goods orders as both consumers and firms rushed to get ahead of the new duties. Trump’s escalating feud with China is key here, with 145% tariffs potentially affecting large swathes of consumer goods and industrial inputs. Indeed, the U.S. trade balance ballooned to record levels in February according to the April data release, with primary metals and electronics the two largest movers. Ultimately, net exports produced a massive drag on Q1 GDP, which contracted at a 0.3% annualized rate according to the April GDP report, despite positive consumption and investment expenditures in the period.

European FX Feast on U.S. Uncertainty

The euro and Swiss franc were the two strongest G10 performers versus the dollar, aided by elevated uncertainty surrounding the U.S. outlook and a potential shift in asset allocations away from the U.S. and towards Europe. Several factors are pulling capital towards Europe including attractive valuations and political stability. Indeed, there has been a role reversal in the pricing of risk-off behaviour; the skew on euro risk reversal options turned negative in April, joining the Swiss franc and Japanese yen as risk-off currencies of choice amid dollar turmoil. The franc’s rally comes despite the Swiss National Bank’s concerns around franc strength, signalling a potential return to negative interest rates.

And Now, We Wait

On “Liberation Day”, Japan was hit with a 24% reciprocal tariff, higher than the EU’s 20%, as well as further tariffs on autos and steel/aluminium. Although the new U.S. tariffs on Japan were higher than expected, the yen rallied as a safe haven currency amid market fears over the tariffs’ impact on U.S. and global growth. The BoJ’s hiking cycle now appears to be on hold, as policymakers may be reluctant to further strain the domestic economy in light of the tariff announcements and as negotiations proceed. The 90-day grace period for reciprocal tariffs was predicated on the negotiation, or renegotiation, of bilateral trade deals during the period. Japan was given priority for negotiations given its close relationship with the U.S., and progress here will likely act as a bellwether for other export economies looking to avert tariff effects.

Canada came out of “Liberation Day” an unexpected winner as it avoided the worst of potential tariffs given that USMCA goods are exempt from duties. CAD rallied on USD weakness but was further supported by rising odds of a Liberal victory in the April general election. Ultimately, Mark Carney and the Liberal party won a plurality of seats and successfully formed a minority government. The Liberal win marked a substantial turnaround from the wipeout expected earlier in the year, when Conservatives enjoyed a wide polling lead. Carney is seen as a bulwark against Trump’s aggression and is expected to play hardball in trade negotiations which are set to begin in May.

Emerging Markets Impacted by Steep Liberation Day Tariffs

EM reactions to “Liberation Day” were mixed, particularly as the Trump administration ratcheted up duties against China, disproportionately affecting the nation and its proxies. The weaker growth outlook for China quickly impacted global base metals prices, which fed into weakness in key commodity currencies, particularly the Chilean peso. That said, a glimmer of optimism on trade negotiations at the end of the month allowed China’s proxies room to rally, boosting KRW and more modestly IDR.

The Brazilian real was a notable outperformer over the period. Under the new U.S. reciprocal tariffs, Brazil faces a 10% baseline rate, though the direct impact is expected to be limited given Brazil’s exports to the U.S. account for roughly 2% of GDP. As BRL has been the currency with the highest real yield amongst major EM currencies and having limited sensitivity to US tariffs helped it to rally even as other LatAm currencies struggled.

N.B.: This summary includes market events and currency movements up to end-of-April.

Issued in the UK by Record Currency Management Limited. All opinions expressed are based on our views as of 7 May 2025 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

We are authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario and Alberta Securities Commission in Canada, and registered as exempt with the Australian Securities and Investments Commission.