Market Commentary – March 2025

- Published: 08/04/2025

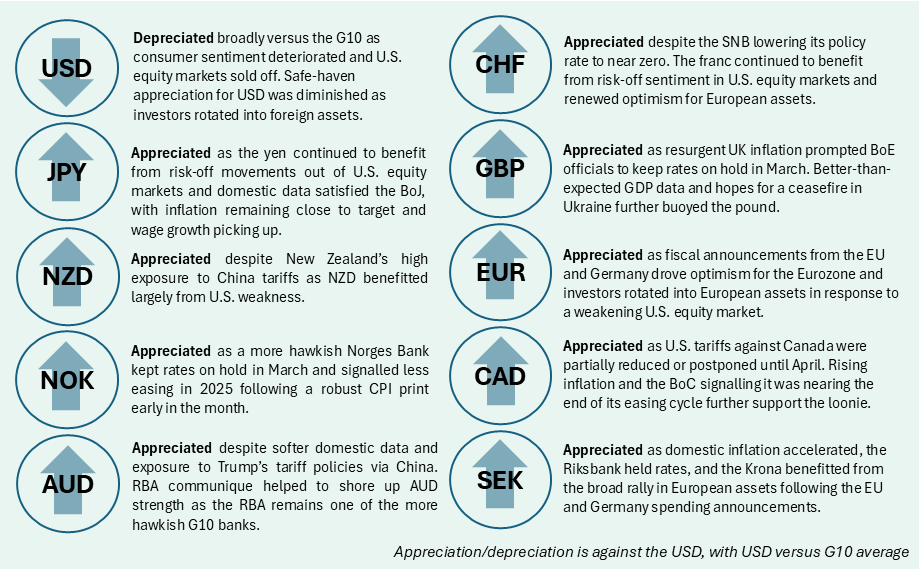

Key Themes Driving Currency Markets

Weight of Uncertainty Sinks USD

U.S. trade policy and the global response to tariffs were a primary FX driver in March, but the focus on tariffs was less singular this month, sharing airtime with various macro and policy developments. USD continued to shed tariff premium as uneven communication and partial postponement of tariffs on Mexico and Canada drew scepticism from market participants. Investors looked ahead to April 2nd , dubbed “Liberation Day” by the Trump administration, for further clarity as the President teased the announcement of “reciprocal” tariffs against all U.S. trading partners. Meanwhile, U.S. economic data came under further scrutiny as activity measures continued to cool and sentiment surveys flashed red. Fed Chair Powell reflected this growing divide between hard and soft data at the March FOMC presser. Powell noted the central bank does not project a downturn; however, he acknowledged moderate pullback in consumer spending and how uncertainty has dampened consumer confidence.

The outlook for Fed policy has become increasingly dependent on the evolution of economic policy, especially trade policy, weakening the Fed’s ability to provide forward guidance amid the uncertainty. The weaker growth outlook, combined with heightened policy uncertainty, weighed heavily on U.S. equities, with the S&P 500 entering correction territory by mid-March. With the dollar’s safe-haven appeal waning, investors instead shifted toward alternatives like gold and European equities, reinforcing the greenback’s downtrend.

A New Renaissance in Europe?

European FX were broadly stronger, benefiting from the aforementioned U.S. weakness, but also surprise fiscal developments within the Eurozone. Early in the month, the EU and Germany made overlapping fiscal announcements, both pledging to boost defence spending, and in the case of Germany, increase infrastructure investment and reform the debt brake rule to allow greater defence outlays. The market was caught off guard, particularly by the German announcement, and in the aftermath, bund yields surged as investors positively rerated the real potential of the economy. By the end of the month, German lawmakers successfully passed both the stimulus package and approved the debt brake reform, boosting future prospects for the European economy. That said, it will take time for new spending to manifest, and questions remain over whether sufficient military equipment can be procured domestically from member states, and whether there will be any productive private sector applications, making passthrough to the currency uncertain. Still, the prospect of a fiscal windfall, combined with weakness in the U.S. fuelled a broad rally in European FX. Additionally, hopes for a ceasefire between Ukraine and Russia remain, though negotiations are ongoing, and Putin has shown no intention of dropping his key demands, including a cut-off of weapons and intelligence aid to Ukraine and the retention of seized territory.

Notably, SEK and NOK turned in the strongest performances of the G10 versus USD during the month, greatly outperforming even European peers. The Scandi rally can be partially attributed to their status as high beta EUR proxies, benefitting from the same events that boosted the euro, but a burst in domestic inflation as well as hawkish central bank communique also contributed to outperformance.

Safe Havens Steadfast

JPY and CHF, the traditional safe havens, also benefited from USD weakness, but to a lesser degree given the risk-on rally in European assets. In the franc’s case, near-zero policy rates and renewed optimism for the Eurozone unwound some of the safe-haven appreciation that benefited CHF during the month, but anxieties over U.S. growth provided a bulwark against a rebound in USDCHF. Japan’s relative isolation from Trump’s trade agenda and strong price dynamics kept the yen afloat as well. Strong gains for unions during the Spring wage negotiations are set to further boost wage growth, raising the possibility of the BoJ bringing hikes forward if price growth continues to accelerate.

Emerging Markets Navigate Tariff Threats, but Brazil Barrels Forward

President Trump’s repeated tariff threats initially weighed on export-oriented EM economies, many of which hold large trade surpluses over the U.S. However, several EM currencies appreciated as tariff fatigue overtook the market and investor focus turned to a slowing US economy. Although most EM central banks have paused their cutting cycles, Brazil stood out by continuing to hike aggressively. The Brazilian Central Bank (BCB) delivered a second consecutive 100bps rate hike in March, aimed at combating inflation and offsetting fiscal stimulus under President Lula. Although early indicators show inflation may have peaked, with higher rates working through the economy, BCB policymakers have remained hawkish, signalling the tightening cycle isn’t over yet. The Brazilian real strengthened in response to the BCB’s super-sized hike and aggressive forward guidance.

N.B.: This summary includes market events and currency movements up to end-of-March.