Market Commentary – December 2024

- Published: 07/01/2025

Key Themes Driving Currency Markets

FOMC wraps up 2024 with hawkish cut

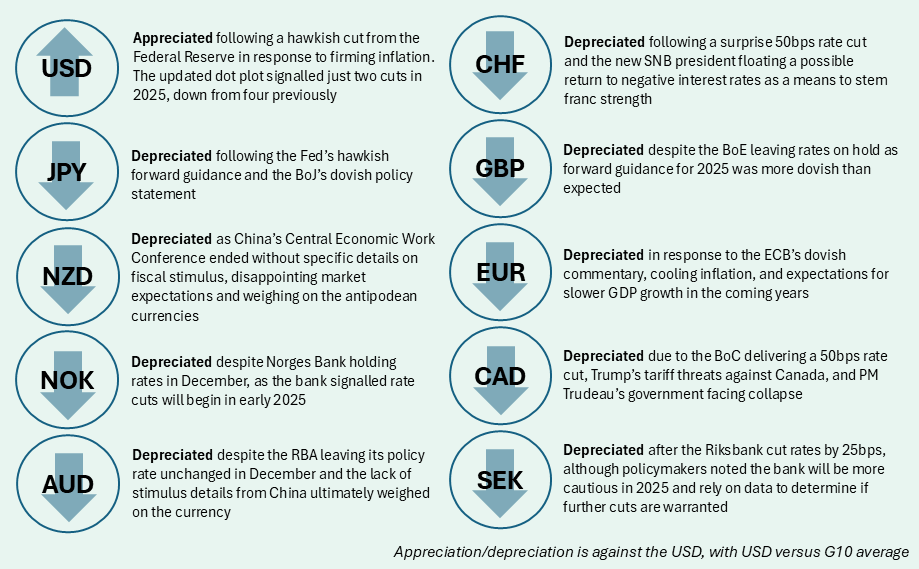

Major central banks convened in droves ahead of the holidays, making their final policy decisions of the year and setting the tone for policy in 2025. The FOMC delivered a widely expected 25bps rate cut its December meeting, but the updated dot plot signalling a shallower rate-cut path in 2025 captured market attention. The median dot implied the Fed will cut just twice in 2025, down from four cuts in the September dot plot. Officials also upped their inflation projections, with at least one member expecting core inflation to accelerate back above 3% in 2025. Powell confirmed in his post-meeting presser that some FOMC officials are incorporating future fiscal policy assumptions into their inflation forecasts. Powell did not name Trump’s proposed tariffs when making this disclosure, but later discussed balancing the risks of tariff-driven inflation and the Fed’s policy response. After previously refusing to comment on the incoming president’s policy agenda, it appears the FOMC is explicitly tuning monetary policy with future fiscal policy in mind. The “hawkish” cut by the Fed drove risk-off moves in equity markets and a surge in Treasury yields, propelling the dollar higher vs. all G10 FX.

Tariff threats and dovish BoC weaken CAD as Trudeau teeters

The loonie got caught in a perfect storm in December as USD/CAD traded near pandemic highs. The Fed’s hawkish turn contrasts with the more dovish BoC which delivered a 50bps cut at its December meeting, encouraged by Canadian CPI returning to its 2% target. Trump’s threat to implement a 25% tariff on Canadian imports further weighed on CAD. Such a tariff would likely have devastating consequences on the Canadian economy as exports to the U.S. comprise ~20% of Canada’s GDP according to IMF estimates. To that end, Canada’s Finance Minister Chrystia Freeland resigned during the month, delivering a scathing letter accusing PM Justin Trudeau of not taking seriously the “grave challenge” Canada faces from Trump’s tariff threats. Freeland’s resignation was the latest blow to Trudeau who has suffered low approval ratings amidst a national cost-of-living crisis. Trudeau is likely on his way out as Jagmeet Singh, the leader of the NDP party who is propping up Trudeau’s government, suggested he will put forward a motion of no-confidence in the new year.

ECB moves to support struggling Eurozone

As expected, the European Central Bank lowered its policy rate by 25bps and accompanying commentary tilted dovish. ECB policymakers expressed satisfaction with ongoing disinflation, but slightly lowered GDP growth projections over the next two years. The ECB’s fresh projections buttressed market expectations for steady rate cuts in 2025, weighing on the euro. An increasingly fractured political landscape further hindered the euro in December. French Prime Minister Michel Barnier’s government collapsed following a no confidence vote over his proposed budget cuts and tax hikes. President Macron named long-time ally and centrist Francois Bayrou as the new PM.

Despite the political gridlock, European financial markets showed signs of recovery, reflecting investor optimism about a potential resolution after Marine Le Pen indicated her far-right party could support a new budget proposal. France’s debt challenges could complicate future fiscal plans, but they largely dismiss the risk of a crisis akin to the eurozone debt turmoil. Optimism for the euro was somewhat dampened by a fresh issue of tariff threats from Trump, however details are light and Trump’s demands center primarily on a desire for Europe to increase oil and gas imports from the U.S.

BoE delivers dovish hold

The Bank of England held interest rates steady at 4.75% but signalled a willingness to continue easing, countering recent market bets on fewer cuts. Three policymakers voted for an immediate reduction, showing a notable dovish shift. BoE governor Andrew Bailey emphasized a gradual approach to further cuts, dismissing the recent pick up of wage inflation as “volatile”. The decision reversed market scepticism, pushing investors toward expecting more rate cuts in 2025 (OIS market is currently pricing between 2-3 cuts). Overall, the BoE’s stance highlighted forward looking caution, relying on forecasts rather than short term inflation surprises. Sterling weakened against the dollar after the “hawkish cut” from the Fed and “dovish hold” of the BoE.

Intervention threat in Japan after BoJ holds rates

Broad USD strength hit the yen particularly hard, which fell to a 5-month low against the greenback and neared previous intervention levels. The Ministry of Finance warned against currency speculation and signalled its willingness to intervene if the yen continues its recent volatile declines. Despite some initial market anticipation of a January rate hike, the Bank of Japan signalled it might wait longer before increasing interest rates, contributing to the yen’s downward pressure. At the December BoJ meeting, policymakers held rates steady, yet one dissenting board member pushed for a 25bp increase, illustrating internal debate over the timing of future hikes.

N.B.: This summary includes market events and currency movements up to end-December.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 7th January 2025 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.