Market Commentary – October 2024

- Published: 06/11/2024

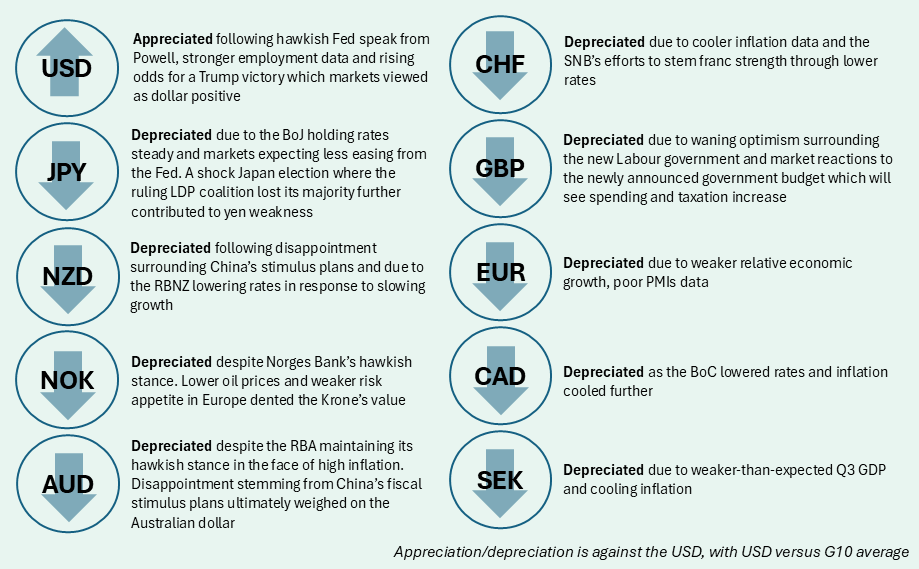

US dollar buoyed by Trump and hawkish Fed communique

The US dollar mounted a strong comeback in October as hawkish Fed comments, stronger employment data, and rising odds of a Trump election victory underpinned the rally over the month. Fed Chair Jerome Powell set the tone early in a NABE interview on September 30. Powell pushed back against the possibility of further “jumbo” rate cuts, arguing that the Fed is not in a hurry and can lower rates over time rather than frontload cuts. Powell’s hawkish comments put a pause to the dollar’s slide, and the October employment report helped kickstart the rebound. Nonfarm payrolls jumped by 254K over the month, beating consensus by more than 100K. The unemployment rate also ticked lower to 4.1%. The labor market is certainly cooler compared to a year ago, but these measures pointed to continued, steady demand for workers. In the aftermath of the report, market pricing for Fed easing pulled back to ~50bps of implied easing by year end which is more in line with the Fed dot plot.

Political developments continued to drive dollar movements in the final weeks leading up to election day. Rising odds of a Trump presidency further boosted the dollar this month as markets view a Trump presidency as dollar positive given his proposed tariffs and tax policies will likely force the Fed to keep rates high. Popular election models expected the race to be a toss-up, and the dollar did lose some momentum in the latter days of October as investors positioned themselves ahead of election day.

Labour’s first budget in power weighs on the pound

In the UK, the post-Labour victory honeymoon seemed to be over, and the British pound’s run of strength halted at the end of October. The UK’s new Labour government at last revealed its much-anticipated budget, containing large increases in public spending. Of the increase, half will be funded by increased taxation (e.g. via higher employer national insurance contributions), while the rest will be borrowed. As markets digested the extra borrowing and front-loaded nature of the budget, and as businesses mulled the impact of higher national insurance, the pound weakened following the announcement.

Relatively weak economic data prompts the Euro to weaken

Across the Channel, Eurozone PMI data disappointed in October, largely due to weaker activity data in Germany and France. The economic weakness, especially in the two largest European economies, raised the possibility for the ECB to accelerate rate cuts to support growth, with discussions around a potential half-point reduction in December. That said, a better-than-expected Q3 GDP report allayed fears of an imminent slowdown, and market pricing moved back towards a 25bps cut in December. Despite the ECB and Fed’s similar expected policy paths, comparatively weaker economic data led the euro to weaken against USD during the month. Eurozone optimism was further dampened by signs of slowdown in China, a potential threat to European export volumes.

AUD and NZD sell off following China stimulus disappointment

China’s economy was under scrutiny in October following a slate of monetary policy announcements in late September. Investors anticipated that authorities would follow up by announcing a fiscal stimulus package to further support economic activity. The Ministry of Finance made a commitment to increase debt issuance to stimulate the economy and stabilize the struggling real estate sector and local governments, but it did not provide any information regarding the overall magnitude, composition and timing of the package. The lack of details disappointed investors and led to a sell-off in AUD and NZD due to their high exposure to China. The upcoming National People’s Congress meeting is a key event, as the NPC has the authority to raise the debt ceiling, a measure that may be necessary before a fiscal package can pass. However, the meeting, originally set for the end of October, was delayed to early November, likely to coincide with the US elections.

Election upset in Japan casts doubt over hiking cycle

Japan held its own elections at the end of October which concluded with an upset. The ruling LDP party lost its majority in the Diet in a surprise result that casts doubt on the future of newly elected Prime Minister Shigeru Ishiba. Uncertainty over the composition of the Diet and the possibility of a hung parliament weighed on JPY in the aftermath of the election. The Bank of Japan (BoJ) met following the election and elected to hold rates, as widely expected. The new bout of political uncertainty is likely to keep the BoJ in a holding pattern as members have expressed discomfort with the idea of raising rates during periods of instability.

N.B.: This summary includes market events and currency movements up to end-of-October.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 6th November 2024 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.