Market Commentary – July 2024

- Published: 07/08/2024

UK and US politics to the fore

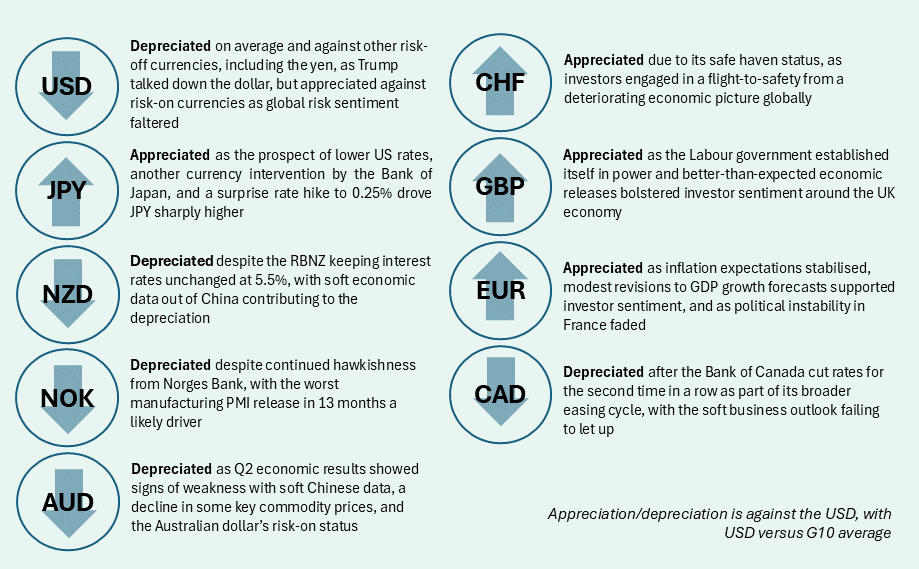

In the UK, Labour secured its largest parliamentary majority since Blair’s landslide in 1997. GBP was stable following the results as its positive performance this year was largely reflective of an expected Labour victory. In the US, President Biden’s poor performance in the first presidential election debate at the end of June handed Trump an early edge in the race, with the shock assassination attempt on Trump further strengthening his lead. Trump’s momentum was strong enough that markets began to reassess the “Trump Trade” early in July. A Trump presidency would mean regulation rollbacks, expansionary tax policy, lower immigration and higher tariffs which all would influence inflation and interest rates. The “Trump Trade” unwound near the end of the month as the race narrowed and Trump made comments critical of a strong USD and weak JPY, leading to a sell-off in the dollar and strength in the yen. Biden’s debate performance and concerns over his age prompted calls from within his own party for him to withdraw from the race. Biden ultimately dropped out on July 21st, with Vice President Kamala Harris effectively replacing him as the Democratic nominee. Since Harris’s entry into the race, polling has narrowed, and the race was deemed a toss-up by pollsters by month-end. We believe a Harris administration would be a continuation of Biden-era policy and be dollar neutral on-balance.

Bank of Japan surprised markets with a policy rate increase

The Bank of Japan’s (BoJ) role was central to currency moves this month. The monetary gap between the US and Japan continued to pressure JPY, with the currency briefly touching a 38-year low of c. 162 vs. USD. JPY then experienced a turnaround in the latter half of July, finishing the month a hair under 150. The prospect of lower rates in the US following another benign inflation release, exacerbated by an opportunistic Japanese Ministry of Finance intervention led to a significant appreciation of the yen. The key moment came at the BoJ’s policy meeting on July 31st, at which it raised its policy rate 15 bps to 0.25% and announced a gradual halving of monthly bond purchases by early 2026. The announcement came as a surprise to markets, and the bank noted upside risks from rising import prices – suggesting that the BoJ are now paying more attention to the impact of JPY depreciation. The ECB also met in July, electing to hold rates steady but leaving the door “wide open” for a September cut. Weaker Eurozone data helped fuel Swiss franc strength in price action reminiscent of safe-haven demand.

A dovish tone to Fed communiqué

The Federal Reserve also held steady in July, but the FOMC statement and Powell’s press conference comments struck a dovish tone. The Fed emphasised increased concern about the job market while still focusing on inflation risks. Powell indicated that the time for cutting rates is approaching and could be decided in the September meeting if data aligns. Powell continued to emphasise the Fed’s data dependent approach, tamping down on market expectations which looked for as many as three cuts by year end. That said, Powell stressed that no decision has been made regarding the September policy announcement, and that the Fed is “attentive to the risks to both sides of its dual mandate”. Going into early August, and just two days following the FOMC meeting, the US labor market posted its second weakest nonfarm payrolls print this cycle, and the unemployment rate rose to 4.3%. The July jobs report provided a clear example of the ongoing deterioration in labor market conditions and puts pressure on the Fed to commence its easing cycle in September. One print does not necessarily make a trend, and the Fed gets one more labor market report ahead of its September meeting. That said, unemployment has been on the rise for several months now, and the Fed now finds itself in a balancing act between its two mandates.

Additional Information

Issued by Record Currency Management Limited. All opinions expressed are based on our views as of 7th August 2024 and may have changed since then. The views expressed do not represent financial or legal advice. We accept no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. This material is provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, or any of our products or investment services. Any reference to our products or services is purely incidental and acts as a reference point only for the purposes of this note. The views about the methodology, investment strategy and its benefits are those held by us.

All beliefs based on statistical observation must be viewed in the context that past performance is no guide to the future. Changes in rates of exchange between currencies will cause the value of investments to decrease or increase. Before making a decision to invest, you should satisfy yourself that the product is suitable for you by your own assessment or by seeking professional advice. Your individual facts and circumstances have not been taken into consideration in the production of this document.

Regulated status

Record Currency Management Limited is authorised and regulated by the Financial Conduct Authority in the UK, registered as an Investment Adviser with the Securities and Exchange Commission in the US, registered as a Commodity Trading Adviser with the US Commodity Futures Trading Commission, an Exempt International Adviser with the Ontario, Quebec and Alberta Securities Commissions in Canada, and registered as exempt with the Australian Securities and Investments Commission.