Reshoring in Perspective: Rethinking Global Supply Chains and the Macroeconomic Implications

- Published: 23/09/2022

The past several years has been marred by a litany of geopolitical and crisis events which has tested global supply chain resilience, highlighting the intricacy and interdependencies of international value chains. Increasingly domestically orientated policymaking has given way to the notion of “reshoring” – the return of outsourced production, manufacturing, labour and technology to a firm’s original country. With the stall in globalization leading such trends, the global stage looks set to be more geopolitically unstable as the dominance of the autocratic and democratic states remains in question. The emergence of blocs along all facets (economical, financial, political, trade) gives way to a new polarized global system as this “slow-balisation” or “deglobalisation” persists.

We set the scene by highlighting the economic status quo of the 20th century as well as the emergence of factors driving the decision to de-risk supply chains, which remains contingent on the ability to re-shore, near-shore or friend shore global value chains. We identify economies which have extensive foreign supply chain risk (such as Australia, New Zealand), and note that thus far trends have mostly been limited to de-shoring of China-based production to other East Asian manufacturers. We also provide readers with a worked currency flow example and a “reshoring impact matrix” to contextualize the macro implications under various re-shoring scenarios.

We conclude that generally EM Asian economies would stand to benefit from the re-alignment of supply chains within the Asia region, whilst a move away from the highly integrated and globalized world would be economically detrimental to China. For the US, the initial costs associated with any supply chain re-configuring could spell inflationary pressures in the short term, whilst long-term productivity gains and general insulation from supply chain risk could eventually see the US economy, domestic assets and currency come out on top.

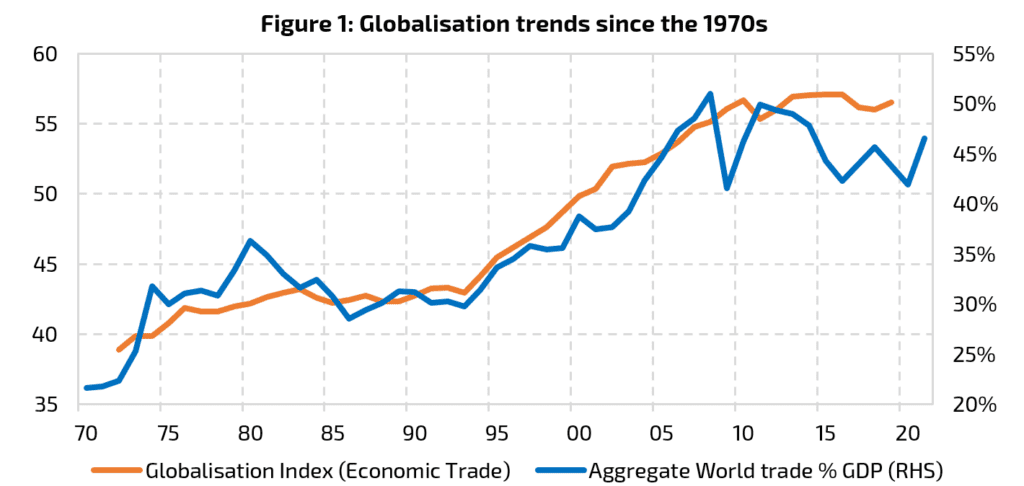

The 20th century saw the synergistic explosion of trade and financial market liberalization alongside technological development, with the multilateral global system largely built post WW2. With the inception of Bretton Woods (1944), General Agreement on Tariffs and Trade (1947), IMF and World Bank, Western policymakers sought a post war economic order built on mutual strategic coordination, all in a bid to overcome economic pain stemming from a period of global depression and trade conflicts, and to disincentivise military conflict through mutual economic dependence. Coupled with another period of industrialization, automation and technological advancements, a recipe was created for a wave of globalization into the end of the 20th century (Figure 1).

This gave way to the creation of complex production structures across international borders and the creation of “Global Value Chains” (GVCs). Within these GVC’s the concentration and costs of lower-cost labour abroad become principal to companies’ production outsourcing decisions. As an example Apple employs an extensive list of over 200 outsourcing partners across 30 countries, largely concentrated in Asia with China contributing 42% of annual production in 2020, whilst only 9% of its supply chain is located domestically.

Source: Record, World Bank, WTO, Swiss Economic Institute / KOF globalization index. The Economic Trade index is a normalised index of trade in goods, trade in services, trade partner diversity, trade regulations, trade taxes, tariffs, and trade agreements.

The conversation around reshoring is not new in any regard – it remains a natural by-product of recent deglobalisation trends, however recent events and changing relationships at the country level are driving a reconsideration of the benefits and particularly the costs associated with off-shoring manufacturing and technology. We see four reasons why re-shoring might be considered by firms and governments.

1. National security concerns: Off-shoring typically decreases the resilience of supply chains (i.e. the ability to withstand a shock), with recent global events revealing the fragility of supply chains. The US-China trade war under Trump’s “Make America Great Again” regime shone light on US dependence on Chinese provision of critical and strategically sensitive goods, while Russia’s intervention in Europe’s gas supplies demonstrate the weaponization of supply links as a “front line defense” tactic. Further to this, as tensions continue to bubble, particularly over Taiwan’s security, the US continues to take a hardline stance that China challenges both the rules-based international economic system and security arrangements in Asia, particularly surrounding territorial claims. As such, the US is cautiously approaching Chinese economic integration whilst attempting to increase their own supply chain resilience in the process. Remarks by Treasury Secretary Janet Yellen in April noted the increasing difficulty in separating economic issues from broader considerations of national interest, including national security and climate change.

2. Economic security concerns: Globalization and automation have supported business margins and competiveness vis-à-vis low input costs and just-in-time processes, however major geopolitical (e.g. Russia and China) or geographical (e.g. the Suez Canal blockage or canal droughts in Germany) supply shocks can severely disrupt previously efficient global value chains. The COVID-induced supply shock displayed an extreme scenario of value chain disintegration in light of burgeoning logistical costs (skyrocketing freight/shipping costs, long lead times, port congestion and dwindling inventories), raw material shortages (semiconductors, key metals) and international labour scarcity. This has prompted policymakers to investigate solutions which mitigate these disproportionate impacts whilst retaining economic competitiveness. Meanwhile the unpredictability of future virus risks, as well China’s firm commitment to a zero COVID strategy continues to challenge the global aggregate supply outlook.

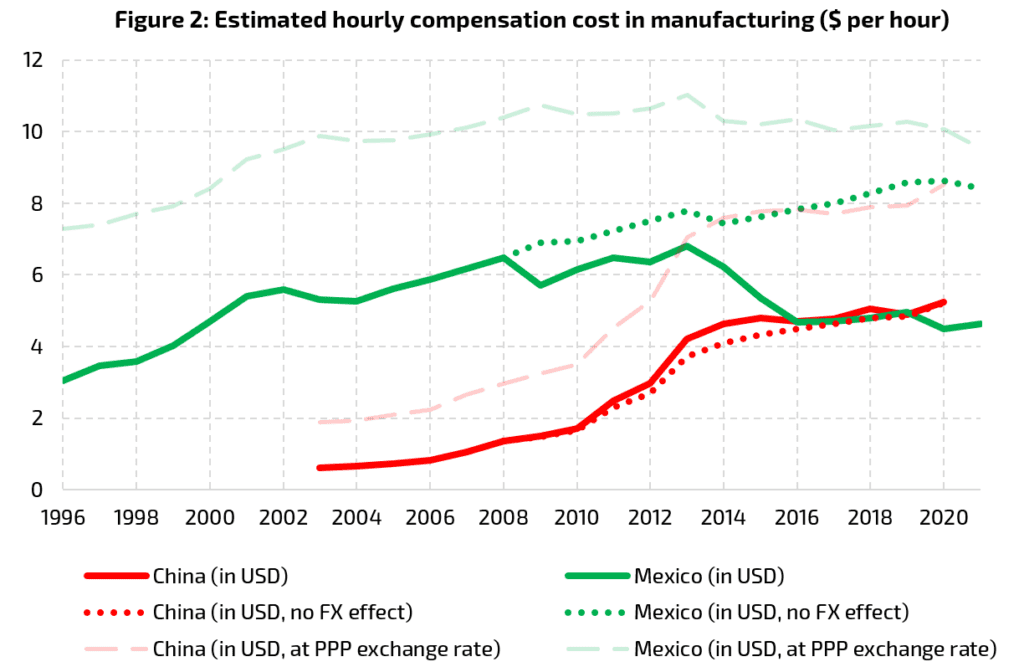

3. Shifting competitive landscape: Real wages in developing economies have been steadily increasing relative to their developed counterparts, notably in Asia and parts of Eastern Europe. In China, the productivity of workers has trailed the advancement in wages, narrowing the cost advantage of offshore production. These dynamics may continue on account of China’s rise of the urban middle class and shrinking working age population. What’s more, the Trump regime’s tariffs on China efficiently demonstrated the sensitivity of offshore operations to deglobalization policies. In the case of China, we estimate that manufacturing labour costs when expressed in US dollars have now intersected those in Mexico (Figure 2). In large part this is due to a more competitive peso, though when expressed in PPP exchange rates, Chinese labour costs would overtake those in Mexico within a few years at the current pace.

4. Climate change: With greater scrutiny on the future path of carbon emissions, rising global temperatures and more extreme weather events, re-shoring is attractive from two angles. First, as laid out in the US Treasury’s 100-day review on supply chains, decarbonization “…will involve a massive build-out of clean energy technology” and that for an issue so central to U.S. economic and national security, the US “…cannot afford to be agnostic to where these technologies are manufactured and where the associated supply chains and inputs originate”. Second is the physical supply chain risks that might emerge under increased prevalence extreme weather events; building out more secure supply chains may be expensive initially, but in the long-run could mitigate climate-related costs in the future.

Whilst re-shoring entire supply chains is unrealistic, the continuing development of automation and technology, the need to secure supply chains for economic and national security interests, and the potential for more insular economic policies such as tariffs, all raise the prospect of re-shoring where possible.

Source: Record calculations, US Bureau of Labor Statistics, Bank of Mexico, China National Bureau of Statistics, Conference Board TED, IMF World Economic Outlook. BLS estimations until 2012 for Mexico and 2008 for China. Thereafter, series are expanded using manufacturing unit labour cost per employee index for Mexico, and manufacturing wages divided by total economy hours worked (assuming similar work hour trends between sectors) for China, converted at average exchange rates for the year.

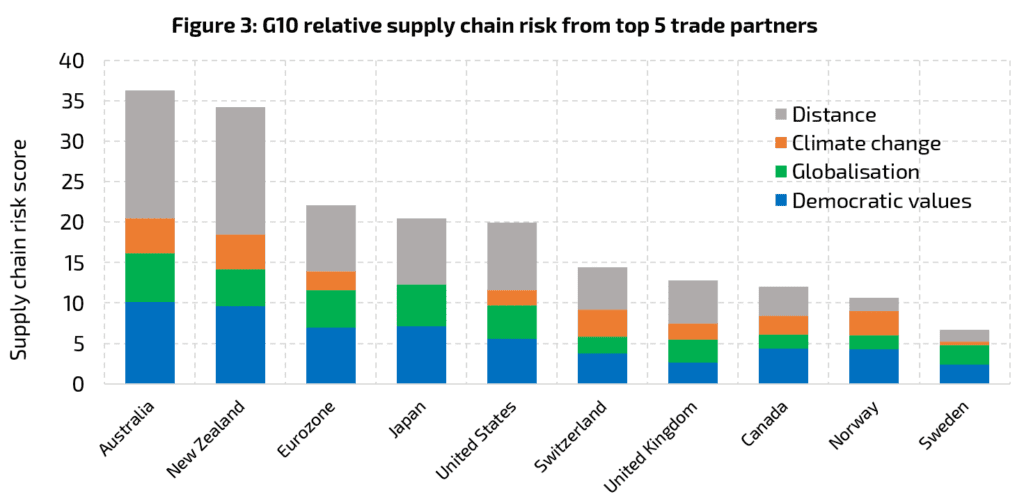

In view of security and climate concerns, it stands to reason that those most at risk of future supply chain failures are countries that do a lot of trade with ideologically and geographically ‘incompatible’ countries. In Figure 3 we calculate risk scores based on four relevant factors with ‘climate change’ representing physical risk to supply chains, ‘distance’ representing the potential difficulty and cost in transporting goods, ‘globalization’ representing de jure openness to the rest of the world, and ‘democratic values’ representing potential geopolitical differences.

According to this measure, Australia and New Zealand are most at risk, given both trade intensity and relations with China, the distance required to trade, as well as the amount of trade done with high-risk climate zones. In the US and indeed the rest of G10, differences with China in ‘world views’ as captured by democracy and globalization are also an issue, accounting for around half of the risk scores. Climate change is showing generally as a risk, but less so in Japan where its own vulnerability is among the highest, and in Sweden where most trade is with lower-risk European countries.

The aforementioned risk factors continue to push corporates to consider the re-shoring of production. However given the costs of redeploying supply chains, limited quantity of US skilled labour in manufacturing, and still higher of cost labour relative to developing countries, it is an expensive and drawn-out proposal. As a result, companies with competitive business models and tight profit margins, particularly in manufacturing, have a more limited ability to pass on re-shoring costs to consumers and would likely increase prices or require government subsidies. Despite growing sentiment by consumers to “buy local”, consumer purchasing power is already under pressure and might challenge onshore business models.

Source: Record, Economist Intelligence Unit, KOF Swiss Economic Institute, Notre Dame Global Adaptation Initiative, CEPII, National Trade Statistics sources. Trade-weighted measures of democracy, globalisation (e.g. ranging from capital account openness to civil liberties), climate change risk, and distance between countries are normalised based on the set of countries covering top 5 trade partners for G10 countries.

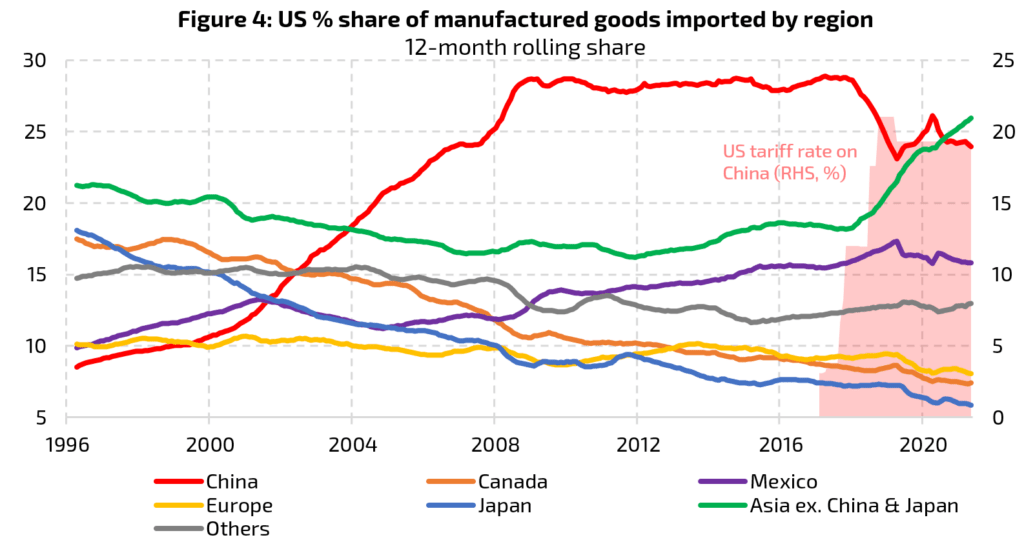

Indeed, the total amount of manufacturing imports as a share of manufacturing output has increased by almost 10 percent since 2010. Instead, a trend of “de-shoring China” or “friend/near-shoring” may emerge where US companies diversify and optimise supply ecosystems around Asia or bring them closer to home such as Mexico or Canada. Asian countries including Taiwan, South Korea, Vietnam and Indonesia with relatively free market democracies are potentially attractive destinations. On top of the tariffs on China, this could be a driving factor behind increasing manufactured imports from Asian economies other than China (Figure 4). This cluster of south east Asian countries continue to benefit from low input costs and trade agreements[1]. Meanwhile, proximity to the US and USMCA trade agreements may help Mexico in attracting reshoring interests.

Source: Record, US Census Bureau. Manufactured goods are calculated to include SITC classification groups 6 (manufactured goods classified chiefly by material), 7 (machinery and transport equipment), and 8 (miscellaneous manufactured articles e.g. telecommunications equipment).

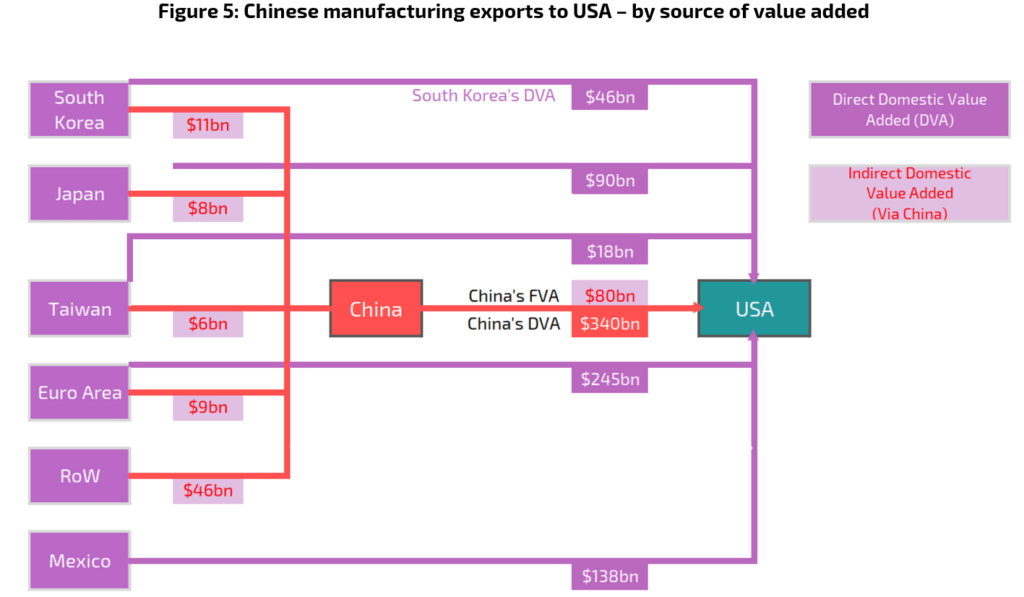

In judging the currency flow impact of supply chain alterations, one must look at the structure of the value chain as opposed to gross bilateral trade levels. This is because exports for example from China (and any other country for that matter) to the USA contain intermediate inputs imported from other countries (e.g. electronic chips from South Korea), otherwise known as ‘foreign value added content in gross exports (FVA)’. In a simplified example, if Chinese exports to the USA are $500bn but China imported $200bn of intermediate inputs from South Korea before adding its own ‘domestic value added content (DVA)’, the netted out currency flows are +$300 worth of CNY, +200 worth of KRW, and -$500 worth of USD.

In figure 5 we map out the key nodes involved in the China to US manufacturing sector value chain using this concept of ‘domestic value added’. On this basis, China’s supply-chain-related currency inflows from the US are approximately $340bn per year, supported by around $80bn of inputs from backward supply chain partners. We look at the manufacturing industry in particular given that it makes up 83 per cent of China’s domestic value add to the US. In the worst case, should Sino-US relations sour, decades of supply chain integration could be unwound, leaving China with fewer high-income onward links in the chain, more sparse foreign direct investment inflows, and without trade and investment partners on which to build technical know-how.

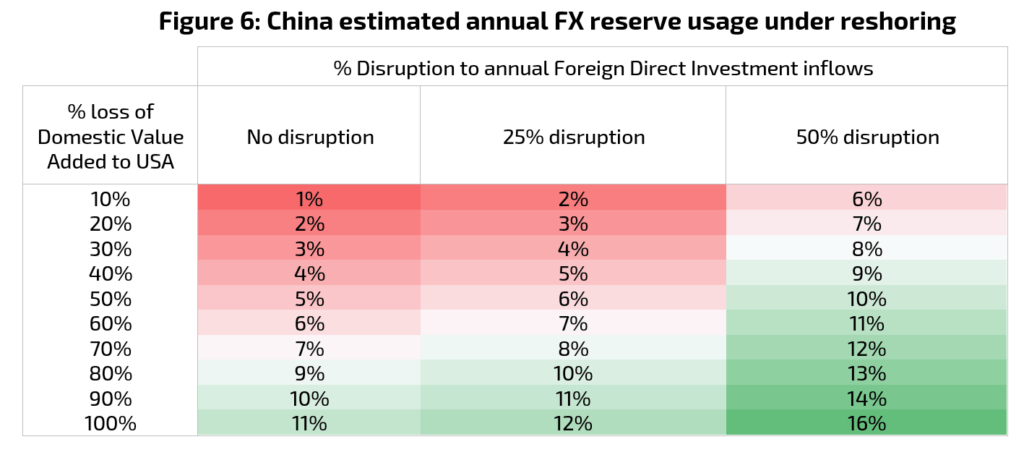

As a thought exercise, we can measure the significance of reshoring scenarios from China by estimating the annual rate of FX reserve erosion should China’s central bank wish to stabilise the currency impact. Here we estimate that a 10% disruption to China’s US supply chain would drain 1% of reserve per annum. We might also assume that inward foreign direct investment (FDI) from the USA and rest of the world is affected, depending on the catalyst for re-shoring; we think a 10% disruption would also see reserve pressures of around 1% p.a. (Figure 6). To give some sense of scale, during China’s hard landing episode in 2014/15, where devaluation was not avoided entirely, the PBoC was forced to draw down reserves at a rate of 10% per annum. Therefore, while strict capital controls might be able to prevent a repeat of capital flight, a dearth of trade and FDI inflows alone could have a similar effect.

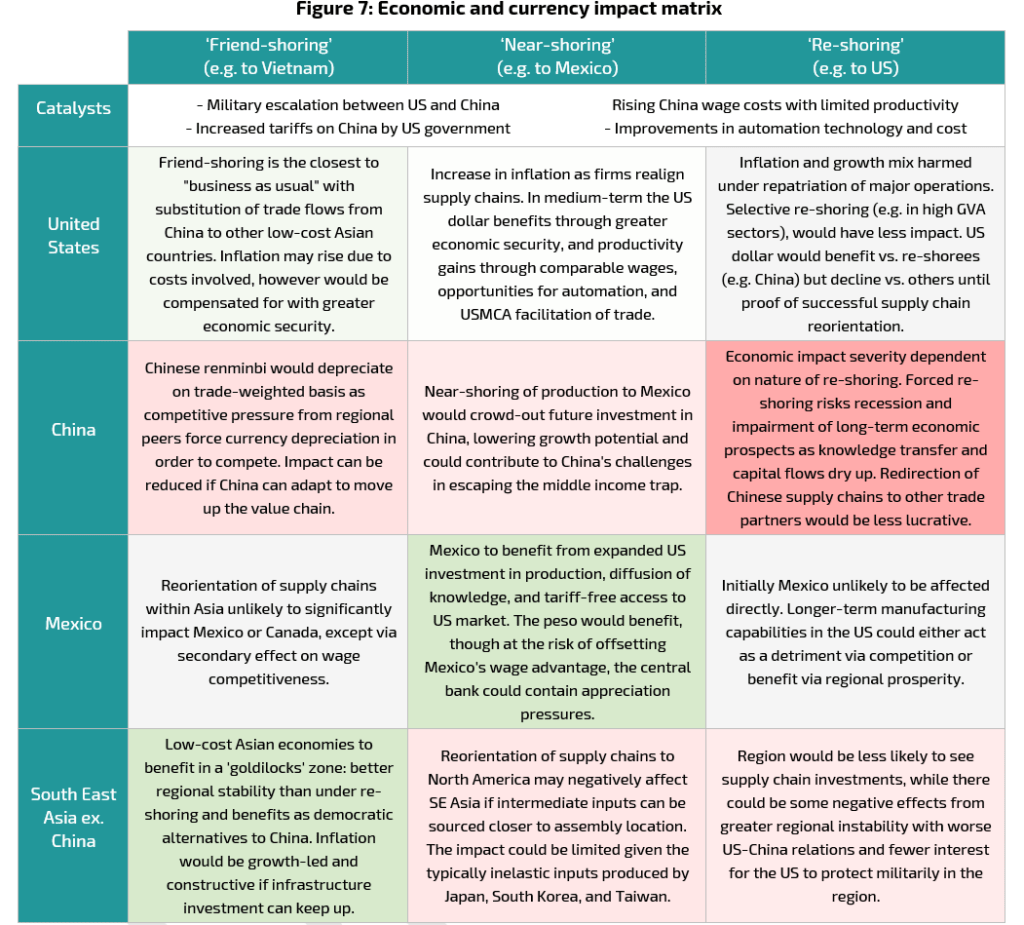

For other Emerging Market countries, the impact should generally be contained, market sentiment permitting. In the near-shoring scenario, Mexico can use its wage advantage and free trade arrangements to deepen ties with the US. Under re-shoring this could also be positive in that more regional trade activity in North America may spill-over to Mexican prosperity, though a successful transition to domestic production in the US could eventually incentivize re-shoring from Mexico. Asia ex. China, friend-shoring with regional stability could see existing supply chains expand (dark purple nodes in Figure 5) and would be supportive of these currencies. On the other end of the spectrum, large scale re-shoring to the US would deprive the region of new investment at a time when regional stability is adversely affected by Western policies towards China, potentially weighing on these currencies.

The broad impact on the US dollar is uncertain as eventual productivity gains and a compression of the trade deficit in value added activity could support the dollar. But this this would have to be weighed against potentially significant near-term stagflationary pressures as all options require major capital expenditure and would initially create a supply shock, spurring inflationary pressure as manufacturers compensate for margin compression. If instead, only new operations were onshored, this could be a slower-moving US dollar positive scenario. The geopolitical backdrop would also matter, as more extreme reshoring scenarios could potentially overlap with armed conflict between the US and China, which presuming somewhat normal functioning of the US economy, would probably see safe-haven demand for the US dollar.

More broadly, the emergence of new trading factions would probably increase the size of currency cycles between factions while shrinking cycles within factions on account of diverging costs of trade and arbitrage.

Ultimately the impact on an economy or currency would depend on the scale and reach of any re-shoring. In Figure 7 we provide a qualitative assessment of the different flavours of US re-shoring (supply chains repatriated), friend-shoring (supply chain diversified nearby), or near-shoring (supply chains relocated closer to home).

Source: Record, OECD TIVA (2018)

Source: Record, Macrobond, State Administration of Foreign Exchange (SAFE) China. Annual FDI data as at 2018.

Many potential outcomes exist as policymakers’ priority of reshoring production/technology generally contrasts with firms’ economic constraints when strengthening supply chain durability. Indeed incentives such as tax breaks, subsidies, R&D grants, and improving automation may not be enough to fully offset the economic costs associated with reshoring, and the motivations of firms/governments may become more aligned or dis-aligned depending on the initial “shoring” catalyst.

The potential impact for the US remains highly uncertain, though there is a strong case that a large scale reshoring scenario is the most economically painful and perhaps most detrimental to EM currencies. In any event, China stands to lose the most unless it can substitute export demand, for example with Belt and Road Initiative partners and other politically aligned nations.

Whilst there seems to be abundant anecdotal evidence of the domestication of US supply chains, the data appears to suggest more of a redistribution of value chains away from China to other East Asian countries thus far. Regardless, considerations of national security, climate change, economic resilience and changing competitive landscapes will bear more heavily in the future planning of supply chains in western economies.

[1] For example, Vietnam is party to 15 free trade agreements including the 2019 EU-Vietnamese FTA and 2018 Comprehensive and Progressive Agreement for Trans-Pacific Partnership